Are you ready to save big on your taxes? As a graphic designer, you’re eligible for a wide range of deductions that can significantly reduce your tax bill. Here are some essential write-offs that can help you unlock savings this tax season.

10 Essential Tax Deductions for Freelance Designers | Tax deductions – Source in.pinterest.com

Slashing Expenses: The Power of Write-Offs

As a graphic designer, you likely encounter expenses that are directly related to your business. These expenses can include everything from software and equipment to marketing and travel. By deducting these expenses on your tax return, you can lower your taxable income and save money on taxes.

17 Big Tax Deductions (Write Offs) for Businesses – Source www.bench.co

Essential Write-Offs: Maximizing Savings

There’s a multitude of write-offs available to graphic designers. Some of the most common include:

- Office expenses (rent, utilities, supplies)

- Equipment and software

- Marketing and advertising costs

- Travel expenses

- Education and training expenses

Unveiling the Secrets of Write-Offs

Maximizing write-offs is not just about knowing what expenses you can deduct. It also involves understanding the rules and regulations surrounding these deductions. For instance, you need to keep proper records of your expenses to support your claims. Additionally, some expenses may be subject to limitations or phase-outs.

Credits, Write-offs, & Tax Breaks for College Students: How to Cash-in – Source www.edumed.org

Types of Write-Offs: A Comprehensive Guide

Write-offs fall into two main categories: above-the-line and below-the-line. Above-the-line deductions reduce your taxable income before you calculate your adjusted gross income (AGI). Below-the-line deductions, on the other hand, reduce your taxable income after you calculate your AGI.

5 Essential Tax Write-Offs for Orange County Property Owners – Source www.acpm1.com

Itemized Deductions: Unlocking Savings

Itemized deductions are below-the-line deductions that can save you significant money on taxes. However, to itemize your deductions, your total itemized deductions must exceed the standard deduction. Some common itemized deductions for graphic designers include:

- Mortgage interest

- Charitable contributions

- State and local taxes

- Medical expenses

Tips for Maximizing Write-Offs

To make the most of your write-offs, consider the following tips:

- Keep accurate records of all business expenses.

- Understand the rules and regulations surrounding write-offs.

- Consider hiring a tax professional to help you maximize your savings.

![]()

Cryptocurrency Tax Write-Off Guide – Source www.cointracker.io

Mileage Deduction: Tracking Travel Expenses

If you use your car for business purposes, you can deduct the mileage rate set by the IRS. This deduction is calculated based on the number of miles driven for business, and it can add up to significant savings.

Fun Facts about Write-Offs

Here are some fun facts about write-offs:

- The average American taxpayer leaves over $1,000 in unclaimed deductions on their tax return each year.

- The IRS has a list of over 100,000 items that you can deduct on your tax return.

- The most common write-off for small businesses is office expenses.

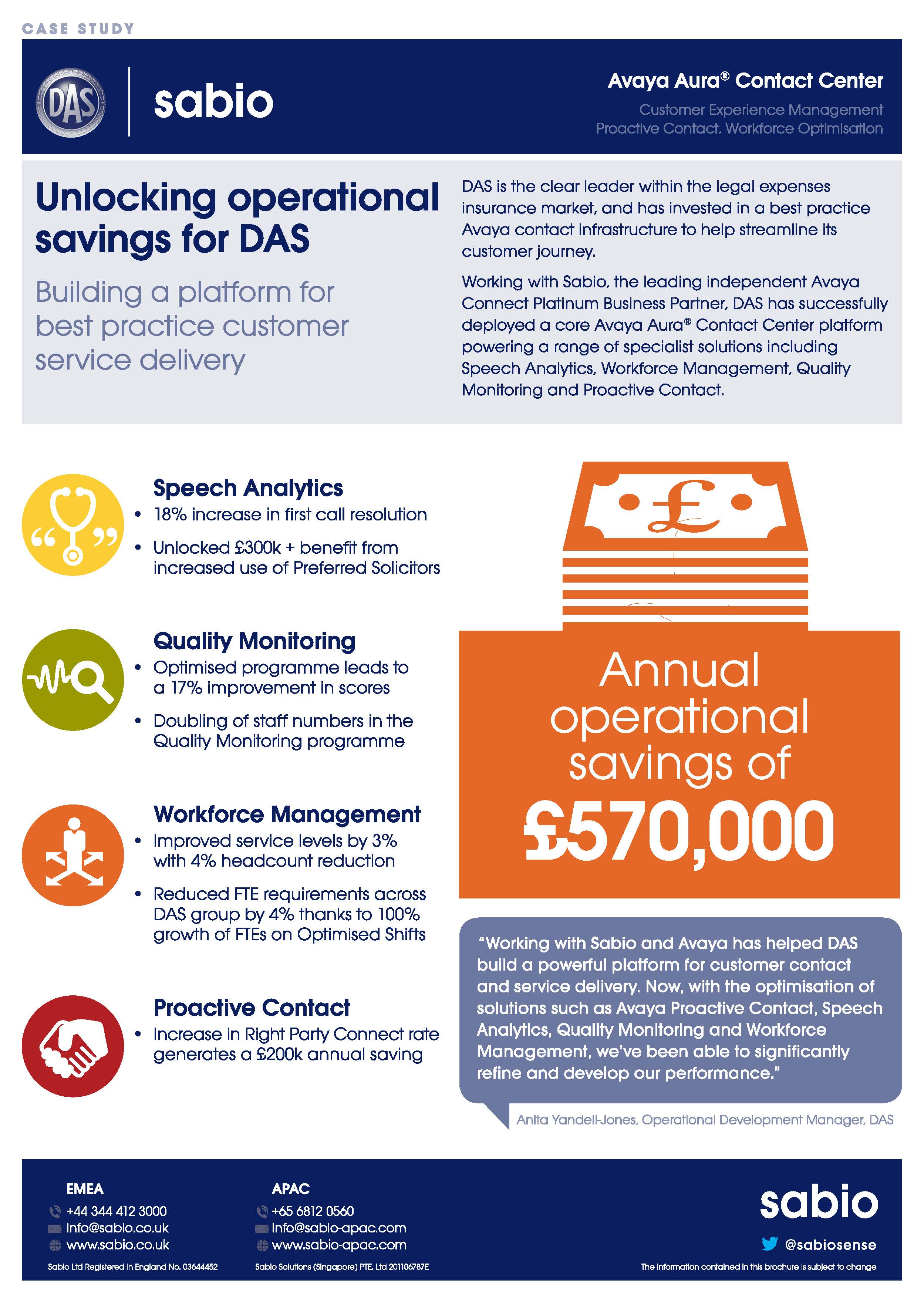

DAS deployed a core Avaya Aura® Contact Centre platform enabling – Source sabiogroup.com

Unlocking the Potential of Write-Offs

Write-offs are a powerful tool that can help you save money on taxes. By understanding the different types of write-offs available to you and keeping accurate records of your expenses, you can maximize your savings and keep more of your hard-earned money.

What if I Miss a Write-Off?

If you miss a write-off on your tax return, you can file an amended return to claim the deduction. You have three years from the date you filed your original return to file an amended return.

Unlocking Savings: A Comprehensive Guide To Multi-Cloud Cost – Source www.expertcloudconsulting.com

Listicle of Write-Offs

Here is a listicle of some of the most common write-offs for graphic designers:

- Office expenses

- Equipment and software

- Marketing and advertising costs

- Travel expenses

- Education and training expenses

- Mileage deduction

- Home office deduction

- Health insurance premiums

- Retirement contributions

- Charitable contributions

Questions and Answers about Write-Offs

Here are some frequently asked questions about write-offs:

- What is the difference between an above-the-line deduction and a below-the-line deduction?

- What are some of the most common write-offs for graphic designers?

- How can I keep track of my business expenses?

- What should I do if I miss a write-off on my tax return?

Conclusion of Unlocking Savings: Essential Tax Write-Offs For Graphic Designers

Write-offs are a valuable tool that can help you save money on taxes. By understanding the different types of write-offs available to you and keeping accurate records of your expenses, you can maximize your savings and keep more of your hard-earned money.