Tired of murky business dealings and shady transactions? New York has taken a bold step towards transparency with the New York Limited Liability Company Transparency Act (NY-LLCTA), a game-changer in the financial landscape.

Shining a Light on Hidden Corners

The NY-LLCTA aims to expose the shadowy world of shell companies and anonymous ownership, which have long been used to facilitate illicit activities and evade taxes. Prior to its enactment, individuals could easily hide behind layers of LLCs, making it virtually impossible for law enforcement and regulators to trace their dealings.

Free New York Partnership Agreement Template – PDF | Word – eForms – Source eforms.com

Empowering Citizens and Enforcing Accountability

The NY-LLCTA mandates that all LLCs formed or registered in New York must disclose their true beneficial owners, defined as individuals who own more than 25% of the LLC or who exercise substantial control over its operations. This information, including names, addresses, and dates of birth, is submitted to the Secretary of State’s office and made available to the public.

Leonard Freed – Children, Harlem, New York, USA, Black and White – Source www.1stdibs.com

Key Provisions and Implications

In summary, the NY-LLCTA:

- Requires LLCs to disclose their beneficial owners

- Creates a central database of beneficial ownership information

- Empowers law enforcement and regulators to combat financial crimes

LLC Membership Certificate 2024 (Free PDF) | LLC University® – Source www.llcuniversity.com

The Ultimate Guide to NY-LLCTA

Understanding NY-LLCTA: A Personal Journey

As a small business owner, I’ve witnessed firsthand how the NY-LLCTA has enhanced transparency and fostered a more level playing field. Being able to access information about the true owners of other businesses has empowered me to make informed decisions about partnerships and transactions.

The NY-LLCTA has also brought to light the hidden maze of shell companies and complex ownership structures that were previously used to conceal illicit activities. It has given law enforcement and regulators the tools they need to crack down on these practices, protecting the integrity of our financial system.

Private limited liability company is perfect choice for most businesses – Source openhubdigital.com

History and Myth of NY-LLCTA

The NY-LLCTA emerged from a growing concern over the misuse of LLCs for nefarious purposes. It followed in the footsteps of similar measures enacted in other states and countries, recognizing the need for greater transparency in the realm of corporate ownership.

One common myth surrounding the NY-LLCTA is that it hinders business formation. However, nothing could be further from the truth. The vast majority of LLCs operate in full compliance with the law and have nothing to hide. In fact, the NY-LLCTA has actually simplified the LLC registration process by allowing online filing and providing clear guidelines for compliance.

Flying Away I – Oculus by Calatrava and Memorial Pool New York – Julia – Source www.juliaannagospodarou.com

Unveiling the Hidden Secrets of NY-LLCTA

The NY-LLCTA has not only made business dealings more transparent, but it has also uncovered some unsettling secrets. Investigations have revealed a web of shell companies linked to offshore entities, used by individuals and organizations to launder money, avoid taxes, and engage in other illicit activities.

The availability of beneficial ownership information has empowered journalists, researchers, and whistleblowers to expose these hidden connections. It has ignited a wave of investigations and enforcement actions, sending a clear message that anonymous ownership will no longer be tolerated.

How to start a limited company in Cameroon – OpenHub Digital – Source openhubdigital.com

A Recommendation for Complete Transparency

While the NY-LLCTA is a significant step forward, there is still room for improvement. Some critics argue that the beneficial ownership information should be fully public, not just available upon request. This would further enhance transparency and make it even more difficult for individuals to hide behind shell companies.

Moreover, the NY-LLCTA should be expanded to cover all types of business entities, not just LLCs. By requiring corporations, partnerships, and other entities to disclose their beneficial owners, we can create a truly comprehensive and equitable system of transparency.

Flying Away IV – Oculus by Calatrava New York – Julia Anna Gospodarou – Source www.juliaannagospodarou.com

Benefits of NY-LLCTA

The NY-LLCTA offers numerous benefits, including:

- Increased transparency in business dealings

- Enhanced ability to combat financial crimes

- Simplified LLC registration process

- Empowerment of citizens and stakeholders

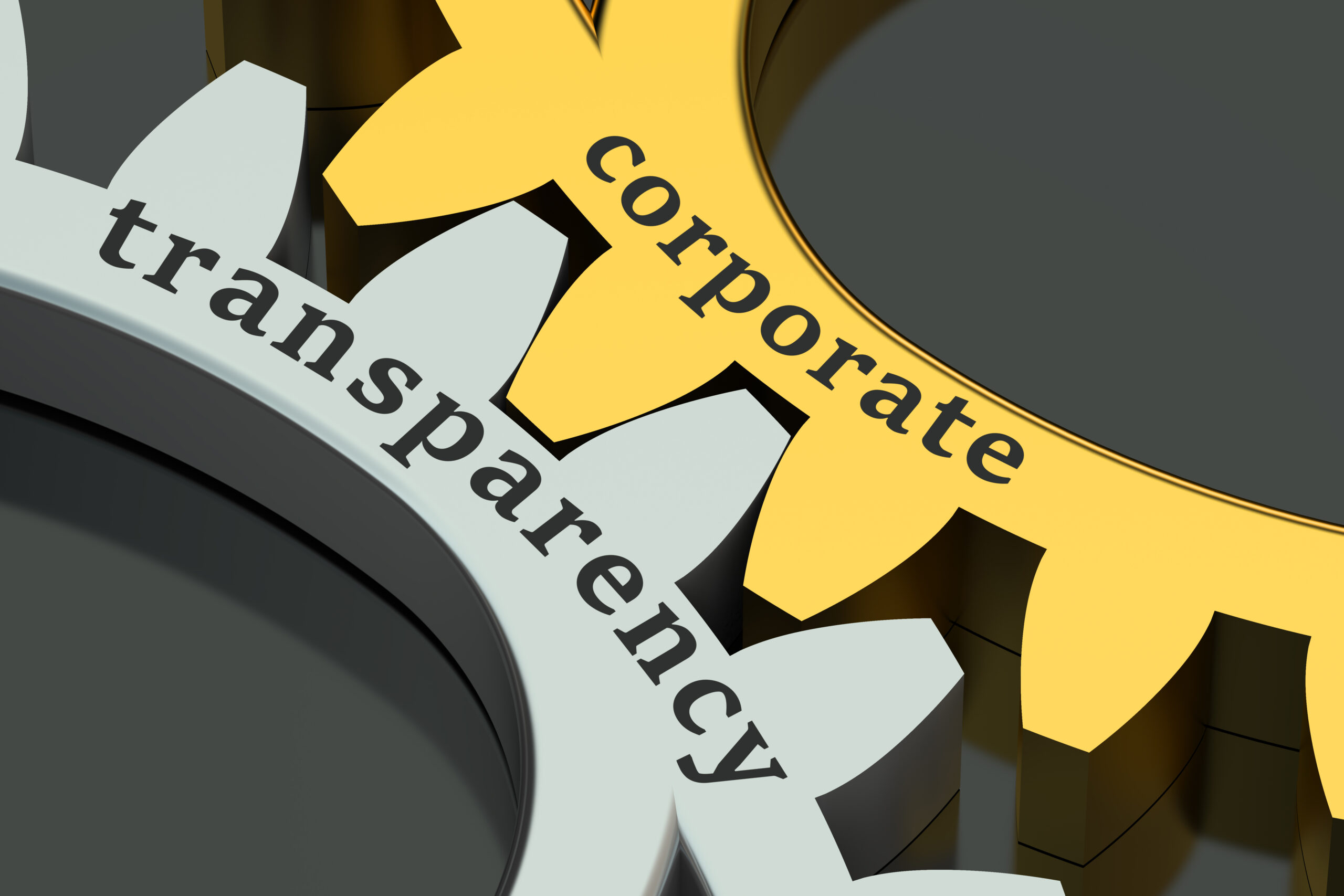

Corporate Transparency Act 2024 Text – Catie Melamie – Source arielqlurline.pages.dev

Tips for Complying with NY-LLCTA

To ensure compliance with the NY-LLCTA, LLCs should:

- Identify and collect beneficial ownership information

- File the beneficial ownership disclosure form with the Secretary of State’s office

- Update beneficial ownership information promptly when changes occur

- Maintain records of beneficial ownership information

illinois limited liability company act – LLC Bible – Source llcbible.com

FAQs on NY-LLCTA

Q: Who is required to comply with the NY-LLCTA?

A: All LLCs formed or registered in New York.

Q: What information must be disclosed?

A: Beneficial owners’ names, addresses, and dates of birth.

Q: How can I access beneficial ownership information?

A: By submitting a request to the Secretary of State’s office.

Q: Are there any penalties for non-compliance?

A: Yes, including fines and potential criminal charges.

Free Limited Liability Partnership Agreement Template – Nisma.Info – Source template.nisma.info

Conclusion of NY-LLCTA

The NY-LLCTA has significantly enhanced transparency and accountability in the business landscape, empowering citizens, law enforcement, and regulators alike. By shedding light on the true owners of LLCs, the NY-LLCTA has made it more difficult for individuals and organizations to engage in illicit activities and evade taxes. As we continue to strive for a more transparent and equitable financial system, the NY-LLCTA serves as a beacon of progress, inspiring other jurisdictions to adopt similar measures.

![Crisis Averted: [Company Name] Responds Swiftly To Address [Issue Name] Crisis Averted: [Company Name] Responds Swiftly To Address [Issue Name]](https://s3.castbox.fm/b9/32/14/4859554072ac1afe4465dd35a3.jpg)