Navigating the complexities of commercial lease agreements can be daunting, especially when it comes to understanding percentage lease arrangements. As a tenant or landlord, it’s crucial to grasp the nuances of rent calculations to make informed decisions. This guide will delve into Percentage Lease: Understanding Rent Calculations in Commercial Leases, providing insights into how these arrangements work, their implications, and strategies for optimizing lease terms.

When navigating commercial leases, understanding the different types of rent structures is paramount. Percentage lease arrangements, in which rent is tied to a percentage of a tenant’s gross sales, present unique considerations. These agreements can be particularly beneficial for landlords seeking to align their income with tenant performance, and for tenants anticipating significant sales growth.

Percentage Lease: Understanding Rent Calculations in Commercial Leases

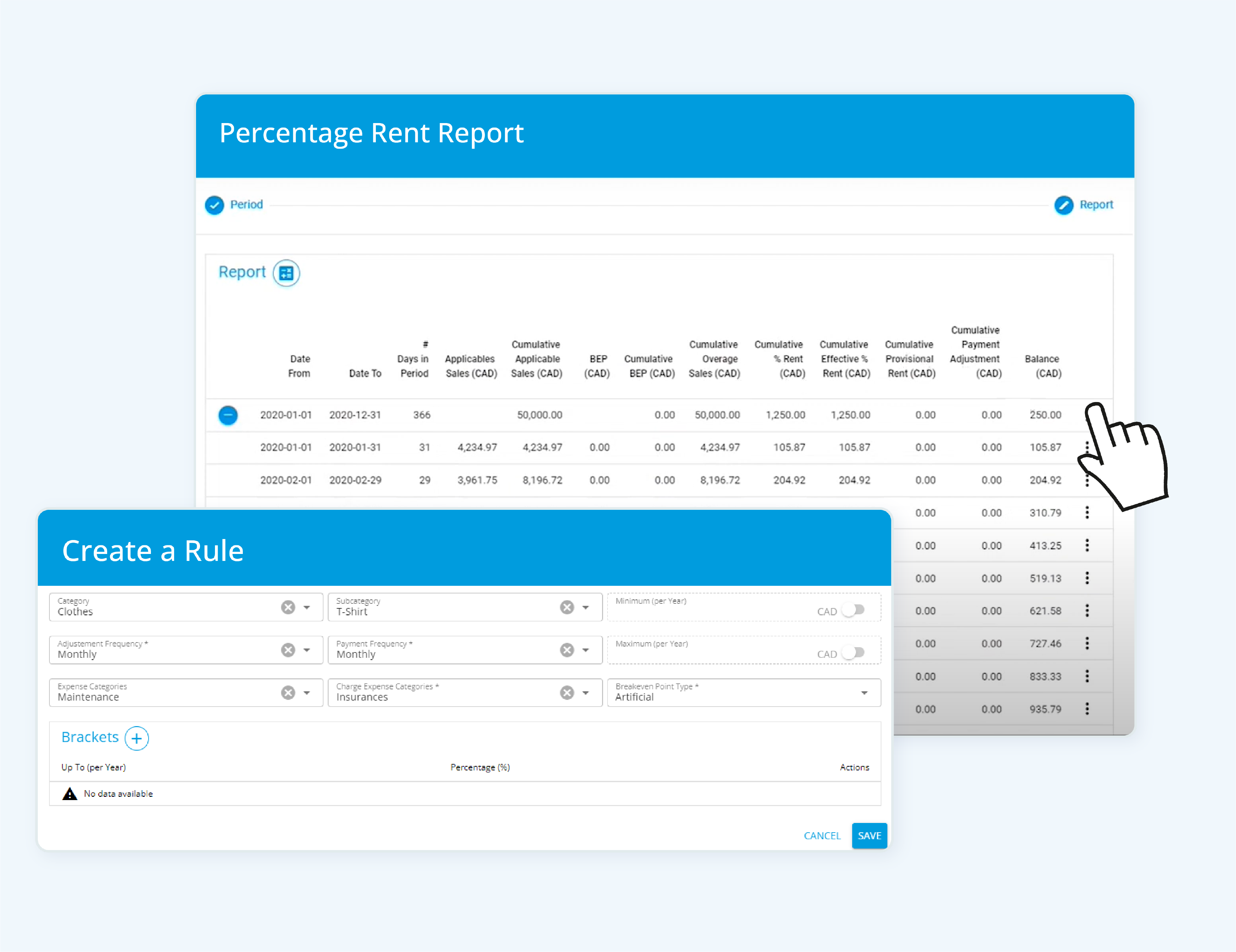

Percentage lease arrangements are characterized by rent payments that fluctuate based on a predetermined percentage of the tenant’s gross sales. This percentage, known as the “percentage rent,” is typically negotiated between the landlord and tenant and is usually a fixed amount. The rent calculation involves multiplying the percentage rent by the tenant’s gross sales for a specified period, which can be monthly, quarterly, or annually.

Nakisa Real Estate Software Reviews, Demo & Pricing – 2024 – Source www.softwareadvice.com

For example, if a tenant agrees to a percentage rent of 5% and their gross sales for a month amount to $100,000, their rent payment would be $5,000 (5% x $100,000). This arrangement provides flexibility for both parties, as the landlord benefits from increased rent during periods of high sales, while the tenant pays a lower rent during slower periods.

History and Myths of Percentage Lease: Understanding Rent Calculations in Commercial Leases

Percentage lease arrangements have a long history in commercial leasing, dating back to the early 20th century. Initially, these agreements were primarily used in the retail sector, where landlords sought to share in the success of their tenants. Over time, percentage leases have gained popularity in other industries, such as restaurants, entertainment venues, and medical offices.

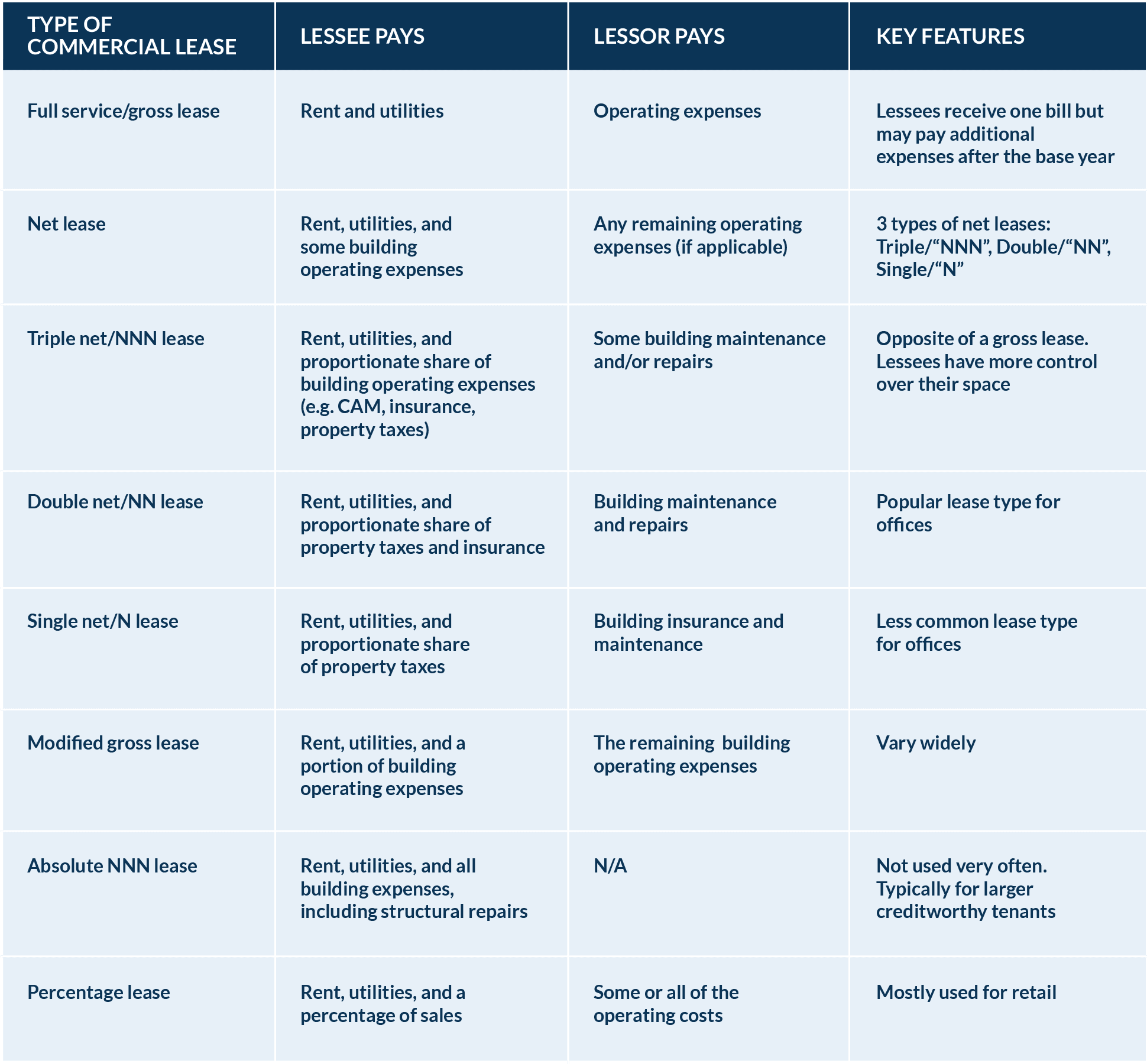

5 Different Types Of Commercial Real Estate Leases, Explained – Source www.squarefoot.com

Despite their widespread use, percentage leases have been subject to various myths and misconceptions. One common misconception is that percentage leases are always more advantageous for landlords than for tenants. While it’s true that landlords can potentially earn higher rent during periods of strong sales, tenants can benefit from lower rent payments during slower periods.

Hidden Secrets of Percentage Lease: Understanding Rent Calculations in Commercial Leases

Understanding the hidden aspects of percentage lease agreements is crucial for both landlords and tenants. One key consideration is the definition of “gross sales.” This term should be clearly defined in the lease agreement to avoid disputes. It’s also important to negotiate the base rent, which is the minimum rent paid by the tenant regardless of sales performance.

Understanding Single, Double, and Triple Net Leases for Commercial Real – Source investment-360.com

Another important consideration is the use of breakpoints. Breakpoints are sales thresholds at which the percentage rent changes. For example, a tenant may agree to pay a 5% percentage rent up to $100,000 in monthly sales, and a 6% percentage rent for sales exceeding $100,000. These breakpoints should be carefully negotiated to ensure fairness for both parties.

Recommendations for Percentage Lease: Understanding Rent Calculations in Commercial Leases

To optimize percentage lease arrangements, several recommendations should be considered. First, tenants should carefully review their financial projections and anticipate their sales performance. This will help them negotiate a percentage rent that is both fair and sustainable. Landlords, on the other hand, should assess the tenant’s business model and track record to determine the likelihood of strong sales performance.

The 7 Types of Commercial Leases Explained – Source learn.g2.com

Both parties should consider seeking professional guidance from attorneys or real estate advisors who specialize in commercial leasing. These professionals can assist in drafting clear and comprehensive lease agreements that protect the interests of both the landlord and tenant.

Percentage Lease: Understanding Rent Calculations in Commercial Leases and Related Keywords

Understanding the complexities of percentage lease arrangements requires familiarity with related keywords. These include:

- Gross sales

- Percentage rent

- Base rent

- Breakpoints

- Common area maintenance (CAM)

- Triple net lease

By incorporating these keywords into your research and discussions, you can deepen your understanding of percentage lease agreements and their implications.

Tips for Optimizing Percentage Lease: Understanding Rent Calculations in Commercial Leases

To maximize the benefits of percentage lease agreements, consider the following tips:

- Negotiate a fair percentage rent based on projected sales performance.

- Clearly define the term “gross sales” to avoid disputes.

- Consider the use of breakpoints to adjust the percentage rent at different sales levels.

- Seek professional guidance from attorneys or real estate advisors to ensure a comprehensive lease agreement.

- Monitor sales performance and adjust the percentage rent as needed to maintain fairness.

Percentage Lease: Understanding Rent Calculations in Commercial Leases and Related Keywords

To further your understanding of percentage lease arrangements, explore the following resources:

- Navigating Retail Leases: A Guide to Percentage Rent Clauses

- Percentage Rent and the Commercial Lease

- Percentage Rent Clauses in Retail Leases

Fun Facts of Percentage Lease: Understanding Rent Calculations in Commercial Leases

Did you know?

- Percentage lease arrangements are often used in shopping malls, where landlords benefit from increased rent during periods of high customer traffic.

- Some percentage lease agreements include provisions for minimum rent payments, regardless of sales performance.

- Percentage leases can be complex to negotiate and require careful consideration of various factors, including the tenant’s financial projections and the landlord’s investment objectives.

How to Percentage Lease: Understanding Rent Calculations in Commercial Leases

To successfully implement a percentage lease arrangement:

- Start by understanding the basics of percentage lease calculations and common industry practices.

- Seek professional guidance from attorneys or real estate advisors who specialize in commercial leasing.

- Negotiate a clear and comprehensive lease agreement that outlines the terms of the percentage rent arrangement.

- Monitor sales performance and adjust the percentage rent as needed to maintain fairness for both parties.

What if Percentage Lease: Understanding Rent Calculations in Commercial Leases

Consider the following scenarios:

- What if the tenant’s sales performance is lower than anticipated? The landlord may agree to reduce the percentage rent temporarily or consider other options to support the tenant’s business.

- What if the tenant’s sales performance exceeds expectations? The landlord may negotiate an increase in the percentage rent or consider profit-sharing arrangements.

- What if the tenant defaults on their rent payments? The landlord may have legal recourse, including the right to evict the tenant and recover unpaid rent.

Listicle of Percentage Lease: Understanding Rent Calculations in Commercial Leases

Here’s a listicle summarizing key points:

- Percentage leases tie rent payments to a percentage of the tenant’s gross sales.

- The percentage rent should be carefully negotiated and clearly defined in the lease agreement.

- Landlords may use breakpoints to adjust the percentage rent at different sales levels.

- Tenants should project their sales performance and negotiate a fair percentage rent.

- Both parties should consider seeking professional guidance to optimize the lease arrangement.

Question and Answer

Q: What is the main advantage of a percentage lease for landlords?

A: Landlords can share in the success of their tenants and potentially earn higher rent during periods of strong sales.

Q: What should tenants be aware of when negotiating