Tired of legal complexities surrounding Delaware Limited Liability Company Member’s Right To Distributions? Let’s demystify this crucial issue and empower you with the knowledge you need.

Managing a Delaware Limited Liability Company (LLC) involves understanding the intricacies of member distribution rights. Members often face challenges navigating these rights, potentially leading to disputes and financial uncertainty. To address these concerns, this article aims to provide a clear understanding of Delaware Limited Liability Company Member’s Right To Distributions, its significance, and strategies for maximizing benefits.

Delaware Limited Liability Company Member’s Right To Distributions

Delaware Limited Liability Company Member’s Right To Distributions refers to the legal entitlement of LLC members to receive a proportionate share of the company’s profits and assets upon dissolution. This right is essential for members to realize the financial benefits of their LLC investment.

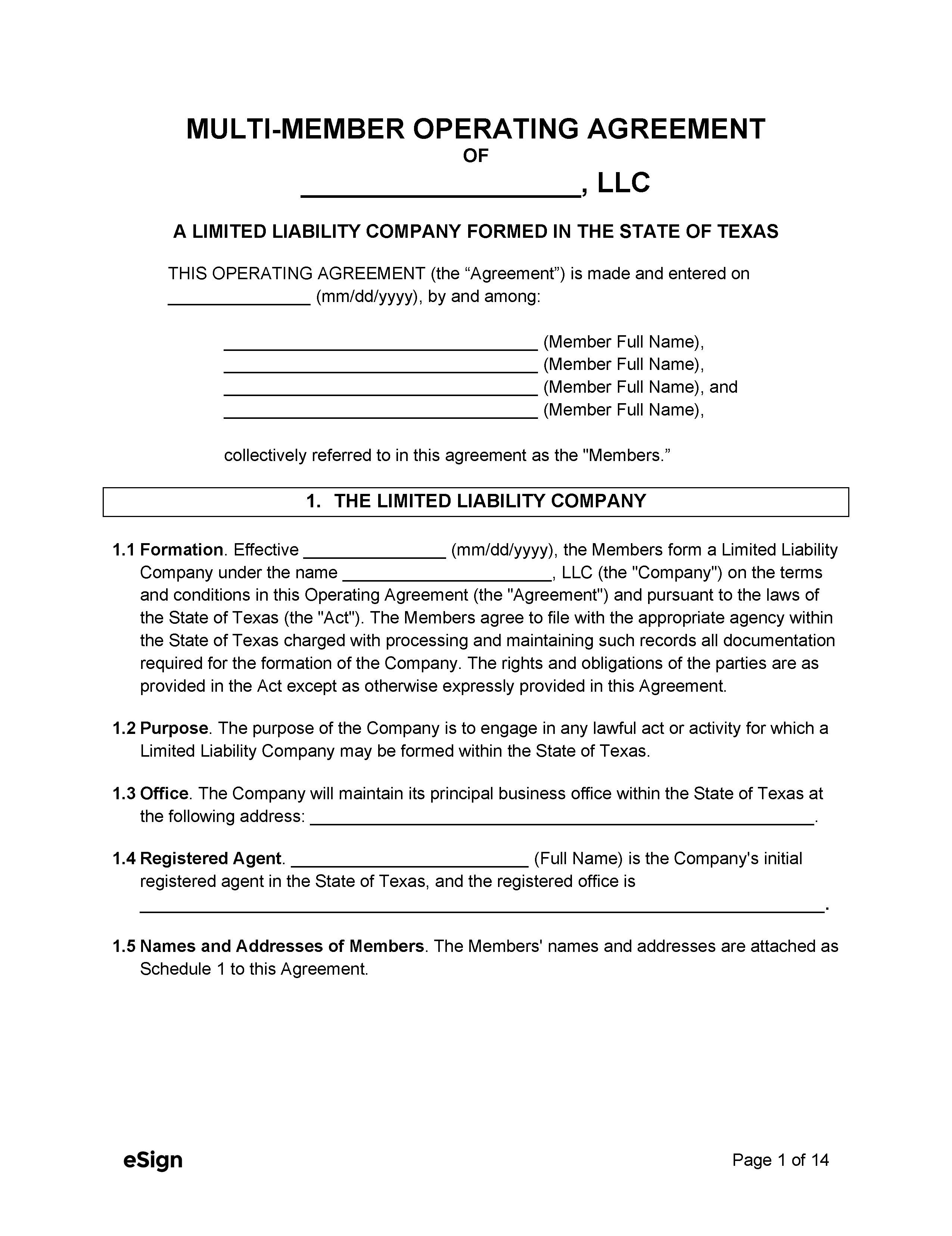

Free Texas Multi-Member LLC Operating Agreement Form | PDF | Word – Source esign.com

The Target of Delaware Limited Liability Company Member’s Right To Distributions

The primary target of Delaware Limited Liability Company Member’s Right To Distributions is to ensure equitable distribution of profits and assets among members. By establishing clear guidelines for distributions, LLCs can prevent disputes and protect member interests. Furthermore, it helps members plan their financial future by providing a framework for anticipating and managing income from their LLC investment.

Summary of Delaware Limited Liability Company Member’s Right To Distributions

In summary, understanding Delaware Limited Liability Company Member’s Right To Distributions is critical for maximizing financial returns and protecting member interests. This article highlights the significance, targets, and strategies related to this important aspect of LLC management.

Personal Experience with Delaware Limited Liability Company Member’s Right To Distributions

As a member of several Delaware LLCs, I have personally witnessed the impact of clear distribution rights. In one instance, a lack of clarity led to a dispute among members, resulting in significant financial losses. However, in another LLC, a well-defined distribution agreement ensured that all members received their fair share of profits, fostering harmony and growth.

Image of a handshake between LLC members, symbolizing agreement on distribution rights.

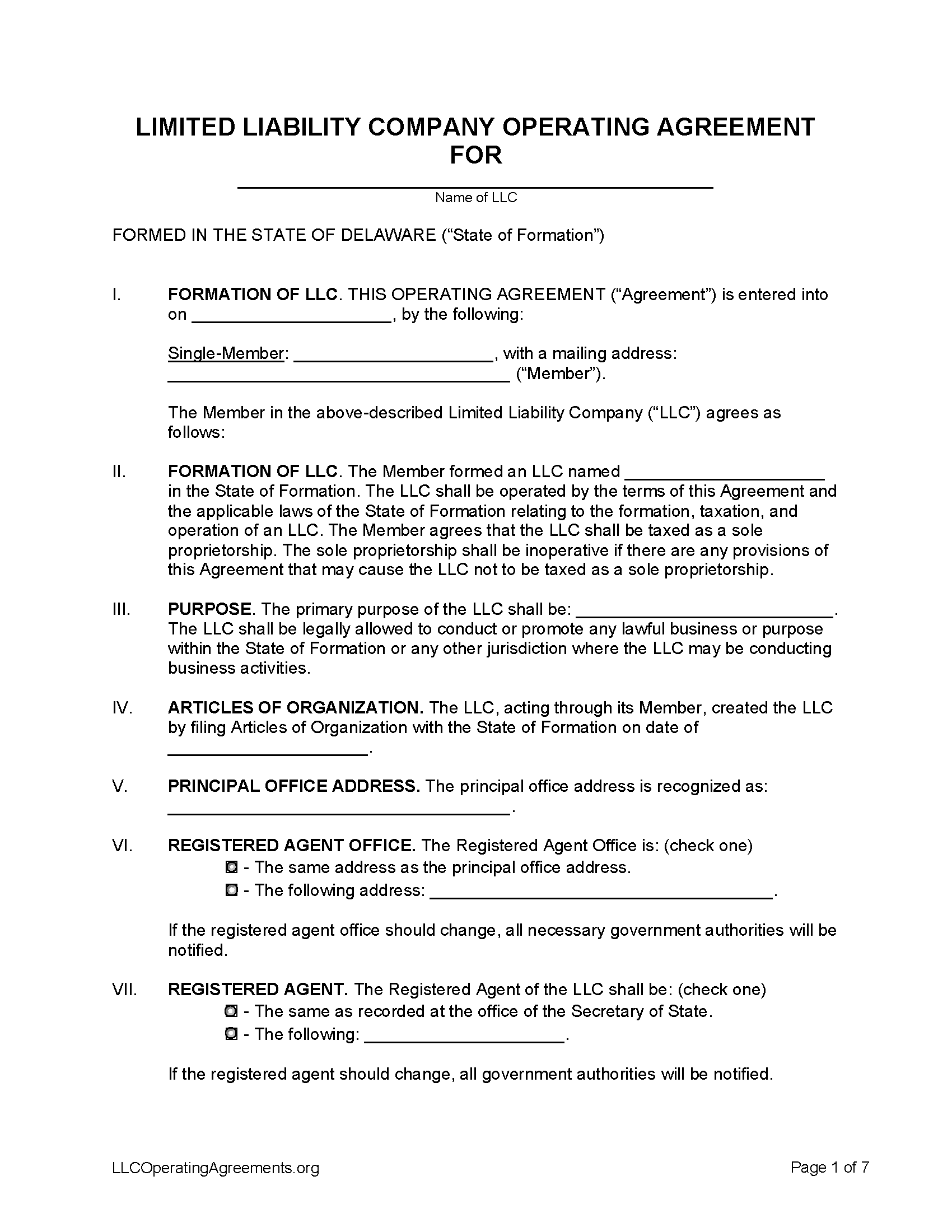

Free Delaware Partnership Agreement Template – PDF | Word – eForms – Source eforms.com

What is Delaware Limited Liability Company Member’s Right To Distributions

Delaware Limited Liability Company Member’s Right To Distributions is a legal right that allows members to receive a portion of the LLC’s profits and assets. This right is typically defined in the LLC’s operating agreement and can vary based on the specific terms agreed upon by the members.

Image of a document labeled “Operating Agreement,” highlighting the importance of clear distribution terms.

Free Delaware LLC Operating Agreements (2) – Free LLC Operating – Source llcoperatingagreements.org

History and Myth of Delaware Limited Liability Company Member’s Right To Distributions

The concept of Delaware Limited Liability Company Member’s Right To Distributions has evolved over time. Initially, LLCs were not recognized as distinct legal entities, and members were personally liable for the company’s debts. However, the advent of LLC statutes in Delaware and other states granted LLCs limited liability protection, solidifying the rights of members to receive distributions without the risk of personal liability.

Image of a historical document illustrating the evolution of LLC laws.

Legal Intelligencer: Significant Recent Changes to the Delaware Limited – Source www.khflaw.com

Hidden Secret of Delaware Limited Liability Company Member’s Right To Distributions

A lesser-known aspect of Delaware Limited Liability Company Member’s Right To Distributions is its potential tax implications. Distributions made to members can be treated as income subject to taxation. Therefore, it’s crucial to consider tax laws and consult with a tax professional to optimize distribution strategies and minimize tax liability.

Image of a calendar with tax deadlines circled, emphasizing the importance of tax considerations.

Delaware Limited Liability Company Act: An Overview | Legal – Source www.morrisjames.com

Recommendation of Delaware Limited Liability Company Member’s Right To Distributions

To maximize the benefits of Delaware Limited Liability Company Member’s Right To Distributions, consider the following recommendations:

- Establish Clear Distribution Terms: Ensure that the LLC’s operating agreement clearly outlines the rules for distributing profits and assets, including the frequency, amount, and criteria for distributions.

- Plan for Future Distributions: Regularly review and update the distribution agreement to adapt to changing business needs and ensure that member interests are protected.

- Communicate Openly: Foster open and transparent communication among members to avoid misunderstandings and disputes related to distributions.

In-Depth Explanation of Delaware Limited Liability Company Member’s Right To Distributions

Delaware Limited Liability Company Member’s Right To Distributions is a fundamental aspect of LLC governance. It enables members to share in the company’s financial success and provides incentives for investment and growth. By understanding the legal framework and best practices related to distributions, LLC members can maximize their financial returns and navigate potential challenges effectively.

Tips of Delaware Limited Liability Company Member’s Right To Distributions

Here are some additional tips for managing Delaware Limited Liability Company Member’s Right To Distributions:

- Consider a Distribution Waterfall: Establish a predetermined order for distributing profits and assets, prioritizing certain members or classes of members.

- Use a Special Allocation: Allow for the distribution of profits and assets in a manner that differs from the members’ ownership interests.

- Create a Reserve Fund: Set aside a portion of profits to cover unexpected expenses or future business needs before making distributions to members.

Delaware Limited Liability Company Member’s Right To Distributions

Delaware Limited Liability Company Member’s Right To Distributions is a crucial component of LLC management. By understanding and implementing best practices, members can optimize financial returns, mitigate risks, and foster a harmonious operating environment within their LLC.

Fun Facts of Delaware Limited Liability Company Member’s Right To Distributions

Did you know that:

- Delaware is often referred to as the “Corporate Capital of the World” due to its favorable business laws, including those governing LLCs and member distributions.

- The first LLC statute was enacted in Wyoming in 1977, but Delaware’s LLC statute, adopted in 1988, is widely regarded as the most comprehensive and flexible.

- Distributions made to members can be subject to both federal and state income taxes, so it’s essential to consider tax implications when planning distribution strategies.

How to Delaware Limited Liability Company Member’s Right To Distributions

To ensure effective management of Delaware Limited Liability Company Member’s Right To Distributions, follow these steps:

- Review the LLC’s Operating Agreement: Carefully examine the provisions related to distributions, ensuring clarity and alignment with member expectations.

- Consult with an Attorney: Seek legal advice from an experienced business attorney to interpret the operating agreement and address any potential issues.

- Maintain Open Communication: Encourage open dialogue among members to discuss distribution expectations, concerns, and potential modifications to the agreement.

What if Delaware Limited Liability Company Member’s Right To Distributions

In certain circumstances, a member may not receive distributions from the LLC. This can occur due to:

- Negative Capital Account: If a member’s capital account has a negative balance, distributions may be withheld until the balance is restored.

- Creditor Claims: If the LLC has outstanding debts, creditors may have priority over members in receiving distributions.

- Dissolution of the