If you’re like most people, you could probably use some help managing your finances. But with so many different financial advisors out there, how do you know who to trust? To help with this, we’ve put together a directory of some of the best financial advisors in the country. With our directory, you can easily find an advisor who meets your specific needs, so you can be sure that you’re getting the best possible advice for your financial situation.

Looking for the Right Financial Advisor?

Finding the right financial advisor can be a daunting task. There are so many different factors to consider, and it can be difficult to know where to start. But don’t worry, we’re here to help. With our directory, you can easily find an advisor who meets your specific needs, so you can be sure that you’re getting the best possible advice for your financial situation.

Our Directory of Financial Advisors

Our directory of financial advisors includes a variety of professionals, from those who specialize in investment management to those who provide comprehensive financial planning services. We’ve carefully screened each advisor to ensure that they meet our high standards of professionalism and ethics, so you can be sure that you’re getting the best possible advice.

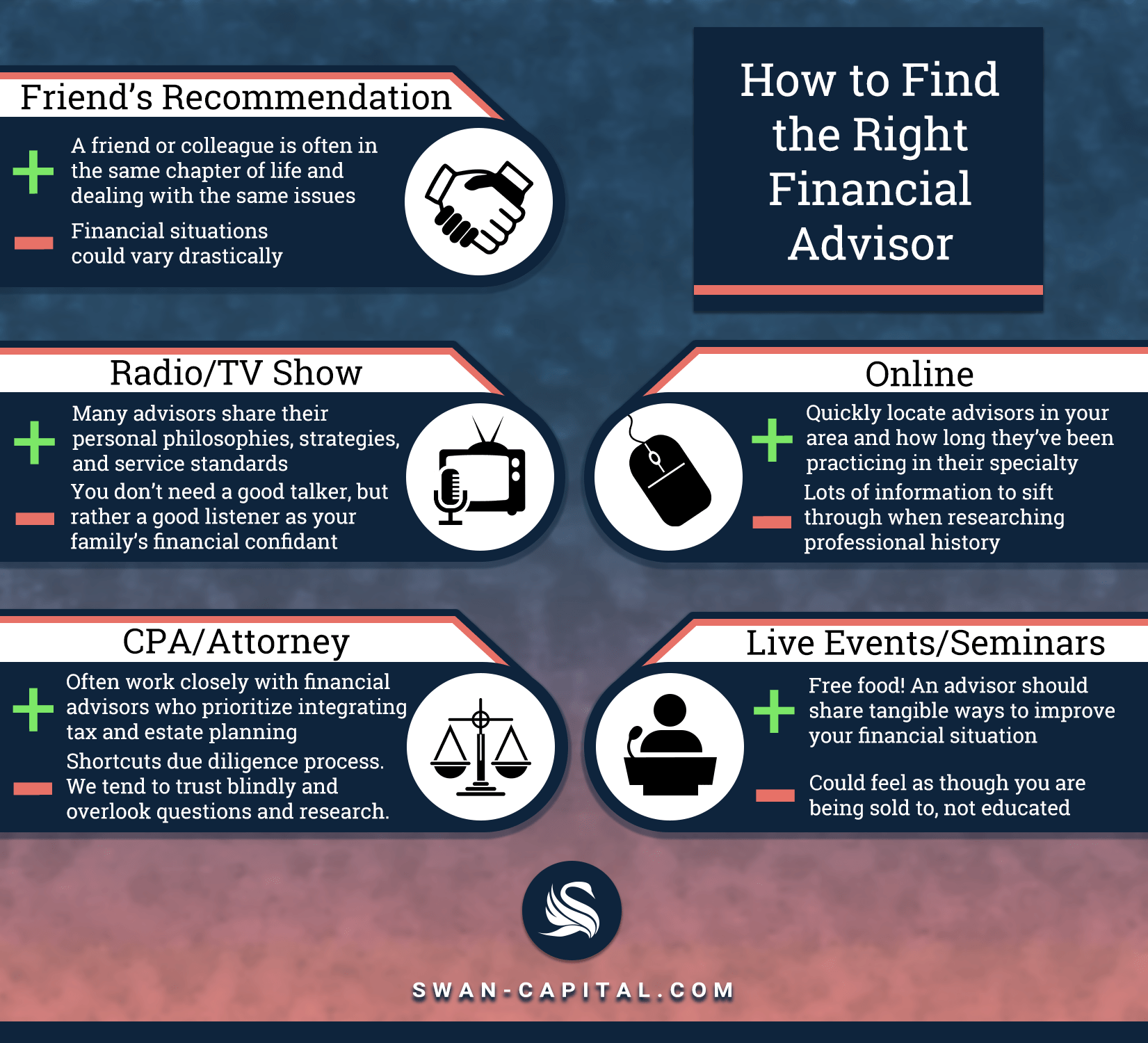

How To Find the Right Financial Advisor | SWAN Capital – Source swan-capital.com

Find the Right Financial Advisor for Your Needs: Expert Advice and Directory

Finding the right financial advisor can be a daunting task. But it doesn’t have to be. With our free online directory, you can easily find an advisor who meets your specific needs. Our directory includes a variety of professionals, from those who specialize in investment management to those who provide comprehensive financial planning services.

I know what you’re thinking. You’re thinking, “I don’t need a financial advisor. I can handle my own finances.” But the truth is, even the most financially savvy people can benefit from working with a financial advisor. A good financial advisor can help you make better investment decisions, save for retirement, and plan for your financial future.

If you’re not sure whether or not you need a financial advisor, here are a few questions to ask yourself:

- Do you have a clear financial plan?

- Are you comfortable managing your own investments?

- Do you have a good understanding of your financial goals?

If you answered “no” to any of these questions, then you may want to consider working with a financial advisor. A financial advisor can help you develop a financial plan, manage your investments, and achieve your financial goals.

Event Registration | Ming & Associates – Source mingassociates.com

What is a Financial Advisor?

A financial advisor is a professional who provides financial advice to clients. They can help clients with a variety of financial planning needs, such as investment management, retirement planning, and estate planning. Financial advisors can be either fee-based or commission-based. Fee-based advisors charge a flat fee for their services, while commission-based advisors earn a commission on the products they sell.

There are many different types of financial advisors, each with their own area of expertise. Some financial advisors specialize in working with individuals, while others specialize in working with businesses. Some financial advisors focus on investment management, while others focus on financial planning. When choosing a financial advisor, it is important to find someone who has the experience and expertise to meet your specific needs.

How To Choose A Good Financial Advisor in Cecil County – Discotecaonline – Source www.discotecaonline.net

History and Myth of Financial Advisors

The history of financial advisors can be traced back to the early days of banking. In the 18th century, wealthy individuals often hired bankers to manage their investments. These bankers would provide advice on which stocks and bonds to buy and sell, and they would also help clients with other financial matters, such as estate planning and tax preparation.

In the early 20th century, the financial planning industry began to grow rapidly. As more and more people began to invest in the stock market, they needed help managing their investments. Financial planners emerged to fill this need, and they quickly became popular with investors of all ages and income levels.

Choosing the Right Financial Advisor for You – Relative Value Partners – Source rvpllc.com

Hidden Secret of Financial Advisors

One of the biggest secrets of financial advisors is that they are not all created equal. Some financial advisors are more experienced and knowledgeable than others. Some financial advisors are more ethical than others. And some financial advisors are more expensive than others.

It is important to do your research before choosing a financial advisor. You should interview several financial advisors and compare their experience, knowledge, and fees. You should also make sure that the financial advisor you choose is a fiduciary, which means that they are legally obligated to put your interests first.

Steps Dentists Take to Build a Retirement Plan – Source www.treloaronline.com

Recommendation of Financial Advisors

If you are looking for a financial advisor, I recommend that you start by asking your friends and family for recommendations. You can also contact your local chamber of commerce or financial planning association. Once you have a few names, you should interview each financial advisor and compare their experience, knowledge, and fees.

It is important to find a financial advisor who you feel comfortable with and who you can trust. You should also make sure that the financial advisor you choose is a good fit for your specific needs.

Useful Tips in Finding the Right Financial Advisor to Help Create Your – Source www.localmarketlaunch.com

Financial Advisors: How to Choose the Right One for You

Choosing the right financial advisor is an important decision. Here are a few tips to help you choose the right advisor for your needs:

- Define your needs. What do you need help with? Do you need help with investment management, retirement planning, or estate planning? Once you know what you need help with, you can start to look for an advisor who specializes in that area.

- Interview several advisors. Once you have a few names, interview each advisor and compare their experience, knowledge, and fees. You should also make sure that the financial advisor you choose is a fiduciary, which means that they are legally obligated to put your interests first.

- Check references. Ask the financial advisor for references from past clients. This will give you a good idea of the advisor’s experience and reputation.

- Make a decision. Once you have interviewed several advisors and checked references, it is time to make a decision. Choose the advisor who you feel comfortable with and who you can trust. You should also make sure that the financial advisor you choose is a good fit for your specific needs.

Event Registration | Ming & Associates – Source mingassociates.com

Financial Advisors: What to Look For

When choosing a financial advisor, there are a few things you should keep in mind:

- Experience. How long has the advisor been in business? How much experience do they have in the area you need help with?

- Knowledge. What kind of education and training does the advisor have? Do they have any certifications or designations?

- Fees. How does the advisor charge for their services? Do they charge a flat fee, an hourly rate, or a commission? You should make sure that you understand the advisor’s fee structure before you hire them.

- Reputation. What is the advisor’s reputation? Have they ever been disciplined by a regulatory agency? Have they been the subject of any complaints?

What To Do When Your Partner Suddenly Dies — Tupicoffs The Independent – Source www.tupicoffs.com.au

Fun Facts of Financial Advisors

Here are a few fun facts about financial advisors:

- The average financial advisor has 10 years of experience.

- The majority of financial advisors are male.

- The average financial advisor charges a 1% fee on assets under management.

- Financial advisors can help you save for retirement, invest for your future, and plan for your financial future.

How to Find the Right Financial Advisor for You

Finding the right financial advisor can be a daunting task. But it doesn’t have to be. Here are a few tips to help you find the right advisor for your needs:

- Start by asking your friends and family for recommendations. They may know a financial advisor who they have been happy with.

- Contact your local chamber of commerce or financial planning association. They can provide you with a list of financial advisors in your area.

- Do some online research. There are a number of websites that can help you find financial advisors in your area.

- Once you have a few names, interview each advisor and compare their experience, knowledge, and fees. You should also make sure that the financial advisor you choose is a fiduciary, which means that they are legally obligated to put your interests first.

What if You Don’t Need a Financial Advisor?

If you are comfortable managing your own finances and you have a good understanding of your financial goals, then you may not need a financial advisor. However, if you are