Is your wallet looking a little thin lately? You’re not alone. Many people struggle with managing their extravagant expenses. But don’t worry, there are some simple tips you can follow to get your spending under control.

Feeling the pinch? You’re not alone

If you’re feeling like you’re always running out of money, you’re not alone. A recent study found that nearly half of Americans live paycheck to paycheck. And it’s no wonder, with the cost of living rising faster than wages.

But there is hope. By following these tips, you can get your spending under control and start saving money.

The Solution

The solution to managing extravagant expenses is to create a budget. A budget is simply a plan for how you’re going to spend your money each month.

To create a budget, you need to track your spending for a few weeks. This will help you see where your money is going and where you can cut back.

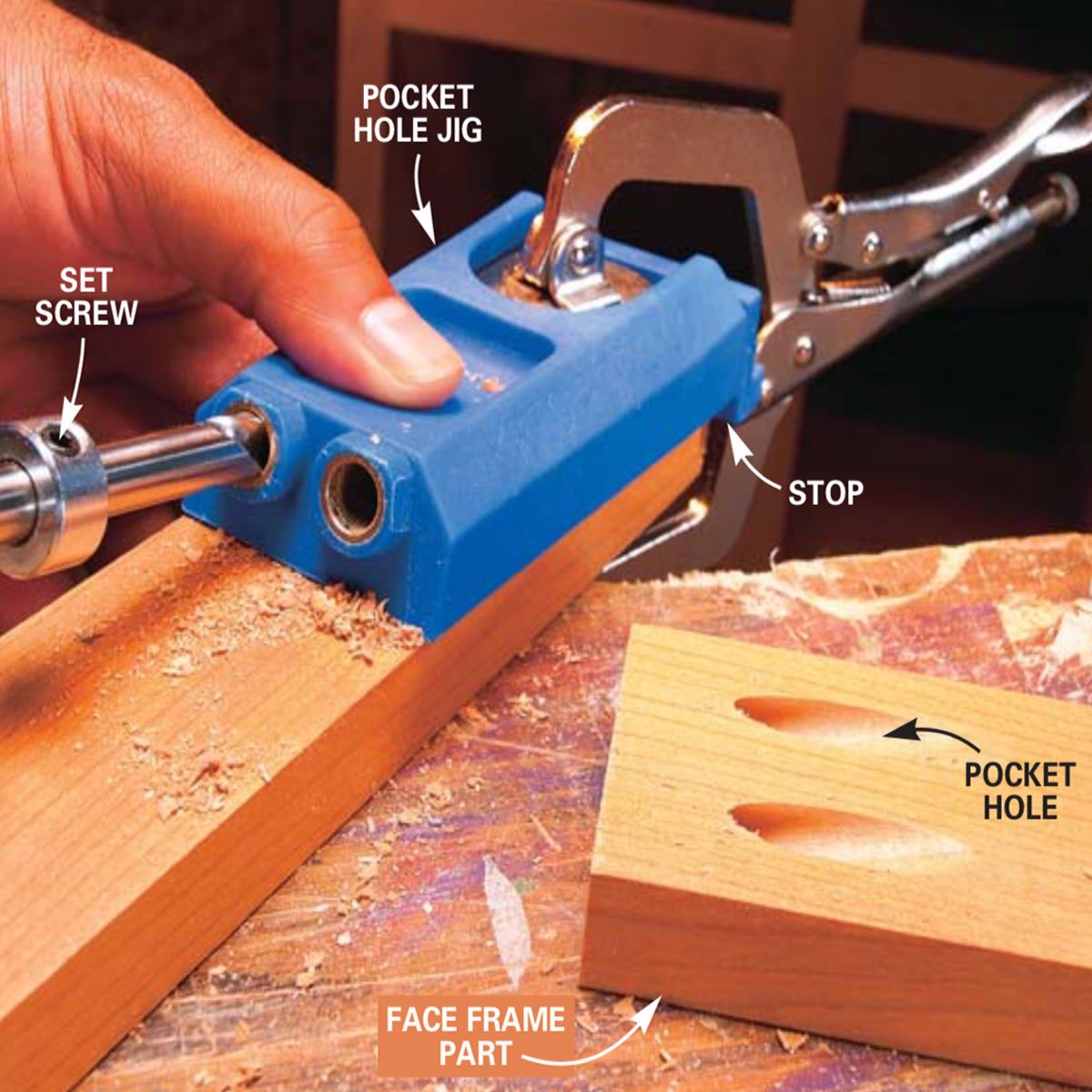

Pocket hole jigs? – Source www.festoolownersgroup.com

Once you have a budget, you can start making changes to your spending habits. Here are a few tips to get you started:

How to Manage Extravagant Expenses

1. Set financial goals. What do you want to save for? A down payment on a house? A new car? A vacation? Once you know what you’re saving for, you can start to make a plan to reach your goal.

Did You Know Ignoring Website Maintenance Can Burn a Hole in Your – Source www.dextel.agency

2. Track your spending. Use a budgeting app or a simple spreadsheet to track your income and expenses. This will help you see where your money is going and where you can cut back.

3. Make a budget. Once you know where your money is going, you can start to make a budget. A budget is simply a plan for how you’re going to spend your money each month.

Warrior burn FO Face off pocket any color stringing | SidelineSwap – Source sidelineswap.com

4. Cut back on unnecessary expenses. Take a close look at your budget and identify any areas where you can cut back. This could include things like dining out, entertainment, or travel.

History of Burn A Hole In Your Pocket: Essential Tips For Managing Extravagant Expenses

The history of budgeting dates back to ancient times. The Babylonians used clay tablets to track their income and expenses. The Romans used wax tablets for the same purpose.

In the Middle Ages, merchants used tally sticks to keep track of their debts. Tally sticks were sticks of wood that were notched to indicate the amount of money owed.

Brandloch auf transparentem Hintergrund 11356494 PNG – Source de.vecteezy.com

Hidden Secrets of Burn A Hole In Your Pocket: Essential Tips For Managing Extravagant Expenses

There are a few hidden secrets to budgeting that can help you save even more money.

1. Negotiate your bills. Many companies are willing to negotiate your bills, especially if you’re a long-time customer. Call your credit card companies, your cell phone provider, and your internet provider to see if you can get a lower rate.

2. Use coupons and promo codes. There are many ways to save money on everyday purchases by using coupons and promo codes. You can find coupons in newspapers, magazines, and online.

trou brûlé sur fond transparent 11356627 PNG – Source fr.vecteezy.com

Recommendations for Burn A Hole In Your Pocket: Essential Tips For Managing Extravagant Expenses

If you’re struggling to manage your extravagant expenses, there are a few things you can do to get help.

1. Talk to a financial advisor. A financial advisor can help you create a budget and develop a plan to reach your financial goals.

2. Join a support group. There are many support groups available for people who are struggling with debt or overspending.

Download Burn Hole Png Transparent Burnt Paper Png Pn – vrogue.co – Source www.vrogue.co

How to Control Extravagant Expenses

There are a few things you can do to control your extravagant expenses.

1. Set financial goals. What do you want to save for? A down payment on a house? A new car? A vacation? Once you know what you’re saving for, you can start to make a plan to reach your goal.

2. Track your spending. Use a budgeting app or a simple spreadsheet to track your income and expenses. This will help you see where your money is going and where you can cut back.

3. Make a budget. Once you know where your money is going, you can start to make a budget. A budget is simply a plan for how you’re going to spend your money each month.

Brandloch auf transparentem Hintergrund 11356492 PNG – Source de.vecteezy.com

Tips for Managing Extravagant Expenses

Here are a few tips for managing your extravagant expenses:

1. Set financial goals. What do you want to save for? A down payment on a house? A new car? A vacation? Once you know what you’re saving for, you can start to make a plan to reach your goal.

2. Track your spending. Use a budgeting app or a simple spreadsheet to track your income and expenses. This will help you see where your money is going and where you can cut back.

3. Make a budget. Once you know where your money is going, you can start to make a budget. A budget is simply a plan for how you’re going to spend your money each month.

Download Burn Hole Png Transparent Burnt Paper Png Pn – vrogue.co – Source www.vrogue.co

Fun Facts about Burn A Hole In Your Pocket: Essential Tips For Managing Extravagant Expenses

Here are a few fun facts about budgeting:

1. The average American spends over $1,000 per year on impulse purchases.

2. The average American has over $5,000 in credit card debt.

3. Only about one-third of Americans have a budget.

How to Implement Burn A Hole In Your Pocket: Essential Tips For Managing Extravagant Expenses

To implement a budget, you need to track your spending for a few weeks. This will help you see where your money is going and where you can cut back.

Once you have a budget, you need to stick to it. This means being disciplined with your spending and not giving in to temptation.

If you find yourself struggling to stick to your budget, there are a few things you can do:

FAQs about Burn A Hole In Your Pocket: Essential Tips For Managing Extravagant Expenses

Q: What is the best way to track my spending?

A: There are a few different ways to track your spending. You can use a budgeting app, a spreadsheet, or simply write down your expenses in a notebook.

Q: How often should I review my budget?

A: You should review your budget at least once a month. This will help you stay on track and make sure you’re not overspending.

Q: What should I do if I find myself overspending?

A: If you find yourself overspending, don’t panic. Just make a few adjustments to your budget and try to stick to it more closely.

Q: What are some tips for saving money?

A: Here are a few tips for saving money:

- Set financial goals.

- Track your spending.

- Make a budget.

- Cut back on unnecessary expenses.

- Negotiate your bills.

- Use coupons and promo codes.

Conclusion

Budgeting is an essential tool for managing your extravagant expenses. By following these tips, you can get your spending under control and start saving money.