Business Income Coverage: Distinguishing Loss Of Rents From Business Income

Imagine if a sudden fire gutted your business premises and brought your operations to a standstill, leaving you with no income and mounting expenses. Business income coverage can be a lifeline in such situations, providing financial support to keep your business afloat.

One crucial distinction within business income coverage is understanding the difference between loss of rents and business income.

Loss of rents coverage compensates the property owner for the rental income they lose due to damage to their property. It’s designed to cover the income earned from leasing or renting out the building or space where the business operates.

The Business Income Coverage Form Applies To – Ethel Hernandez’s Templates – Source imanotalone.blogspot.com

On the other hand, business income coverage protects the business owner from lost income resulting from the interruption of their business operations. It covers things like lost sales, ongoing expenses such as wages and utilities, and the cost of relocating or temporarily operating elsewhere.

California Legislators Attempt to Create Business Income Coverage for – Source insuralex.com

Understanding Business Income Coverage

Business income coverage is a valuable safety net for businesses of all sizes. It provides peace of mind knowing that if a covered event occurs, you’ll have the financial resources to recover and continue operating.

The coverage is typically purchased as an endorsement to a commercial property insurance policy. It’s important to work with an experienced insurance agent to determine the appropriate coverage limits and ensure you have the protection you need.

Business loss infographic concept vector. Losing money everyday and – Source www.vecteezy.com

History and Evolution of Business Income Coverage

Business income coverage has a long and evolving history. It originated in the 19th century as a way to protect businesses from the financial impact of fire. Over time, the coverage has been expanded to include protection against a wider range of perils, such as windstorms, hail, and civil unrest.

As businesses have become more complex and interdependent, the need for business income coverage has grown. Today, it’s an essential part of risk management for businesses of all sizes.

Travelers Insurance Business Income Worksheet – Financial Report – Source excelspreadsheetsgroup.com

Unveiling the Secrets of Business Income Coverage

Understanding the ins and outs of business income coverage can help you make informed decisions about your insurance protection.

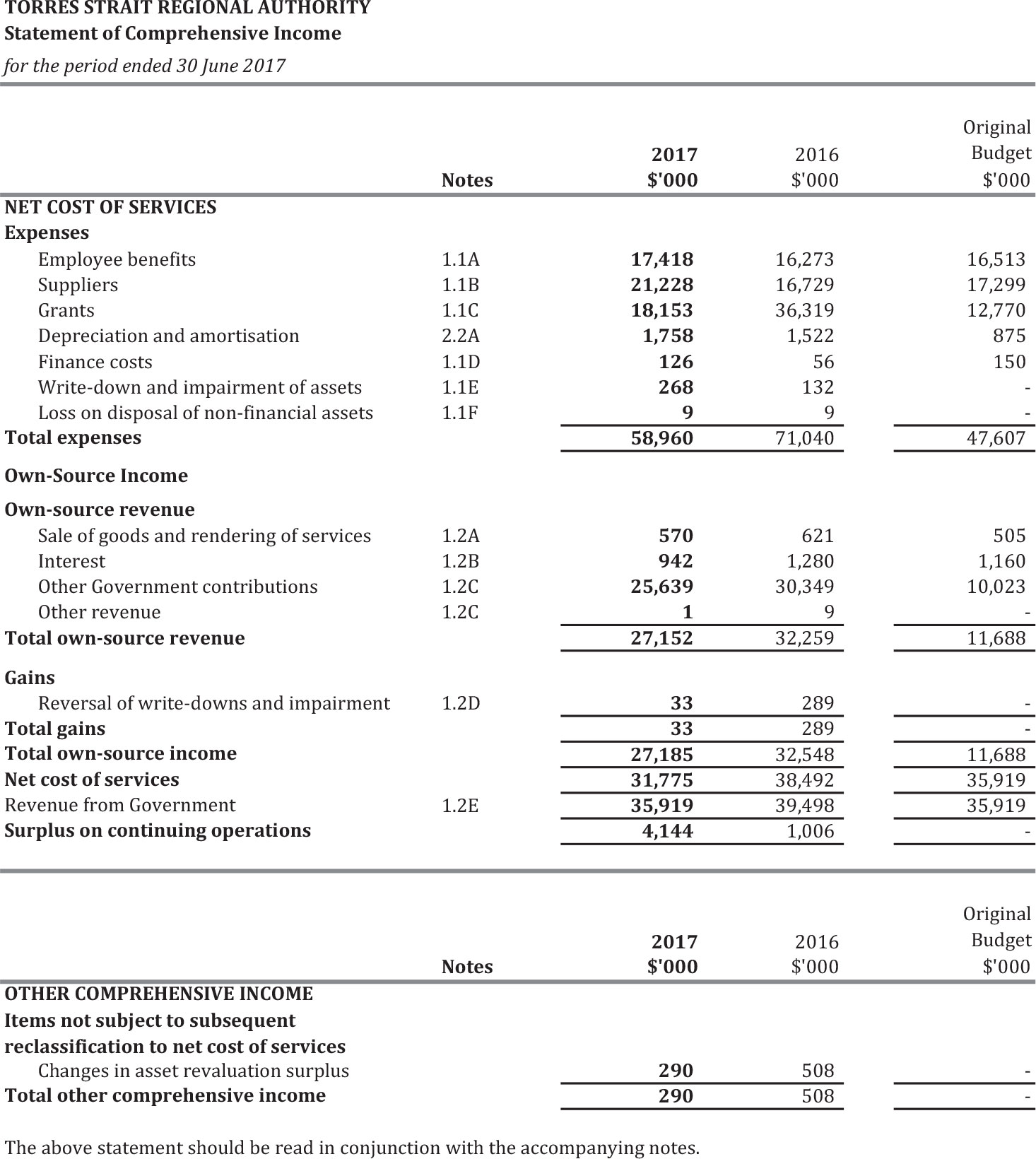

One key aspect is the concept of “actual loss sustained.” This refers to the actual financial loss the business incurs as a result of the covered event. It’s important to document all expenses and lost income during the interruption of business operations.

Additionally, business income coverage may include provisions for extra expenses. These expenses are incurred to minimize the impact of the interruption, such as:

- Increased advertising

- Renting temporary space

- Expediting production

Safeguarding Your Company with Business Income Coverage – Source www.lawriegroup.com

Benefits of Business Income Coverage

Business income coverage provides numerous advantages for business owners:

Protection from Financial Loss: It ensures that your business has the financial resources to withstand the impact of a covered event.

Business Income Calculation Insurance – Financial Report – Source excelspreadsheetsgroup.com

Continued Operations: The coverage helps keep your business operating by providing funds for expenses such as payroll, rent, and utilities.

Reduced Stress: Knowing that you have business income coverage can provide peace of mind during a challenging time.

Business Income Coverage in Action

Imagine if your retail store is damaged by a fire and is forced to close for repairs.

Loss of rents coverage would compensate the landlord for the rental income they lose while the store is closed.

Printable Profits Download – Printable Word Searches – Source orientacionfamiliar.grupobolivar.com

Business income coverage would cover the store owner’s lost sales, wages for employees who can’t work, and the cost of renting a temporary location. This would allow the store to continue operating and minimize the financial impact of the fire.

Fun Facts about Business Income Coverage

Here are some interesting trivia about business income coverage:

The first business income coverage policies were issued in the 1870s.

Business income coverage is not the same as extra expense insurance. Extra expense insurance covers the additional costs incurred to maintain normal operations after a covered event.

Comprehensive Income – Source fity.club

Business income coverage is typically subject to a waiting period before benefits are paid. This waiting period can vary from one policy to another.

Business Income Coverage in Practice

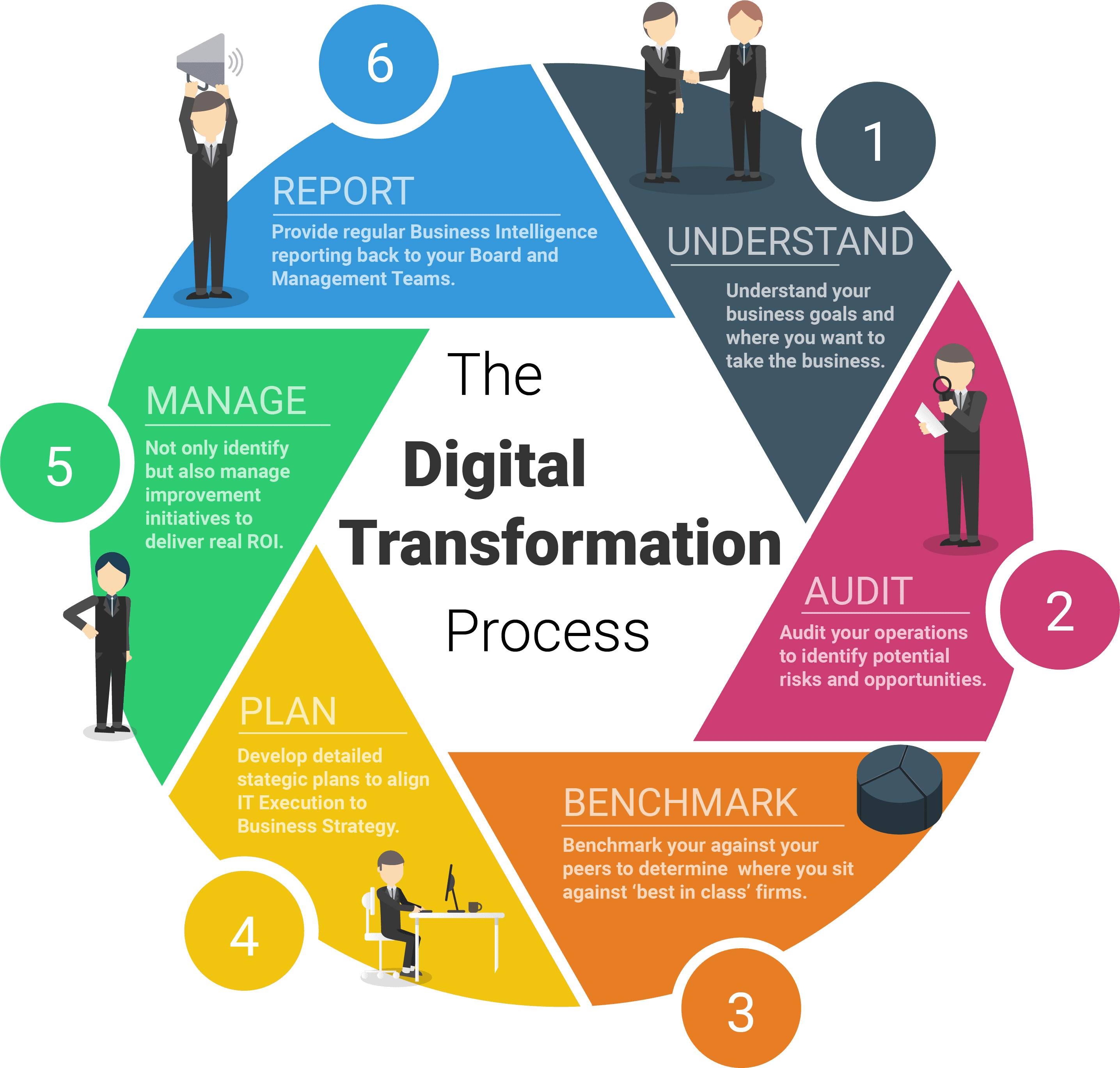

Several steps are involved in obtaining and maintaining business income coverage:

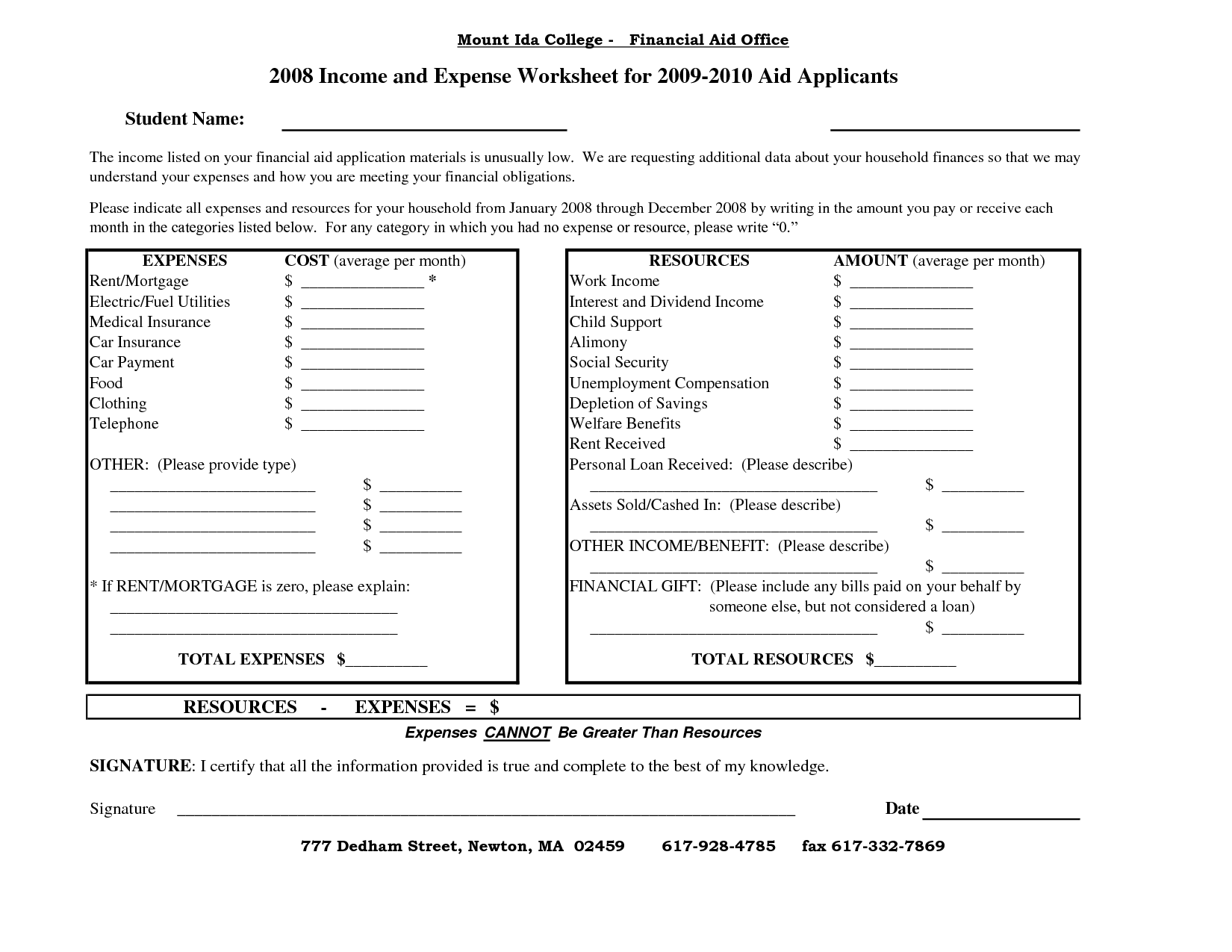

Determine the Coverage Amount: Calculate the potential financial loss your business could face in the event of a covered event.

Choose a Policy: Select a policy that meets your coverage needs and budget.

Report Claims Promptly: Notify your insurance company immediately if a covered event occurs.

Provide Documentation: Submit documentation supporting your claim, such as financial records and proof of lost income.

13 Income Expense Monthly Budget Worksheet / worksheeto.com – Source www.worksheeto.com

Conclusion of Business Income Coverage: Distinguishing Loss Of Rents From Business Income

Understanding the distinction between loss of rents and business income is crucial for business owners. Business income coverage provides a critical safety net to help businesses recover from the financial impact of a covered event.

Contact Us! – Source vargassm.com

By working with an experienced insurance agent and ensuring you have the appropriate coverage, you can protect your business and give yourself peace of mind.

## Frequently Asked Questions

What is the difference between loss of rents and business income coverage?

Loss of rents coverage compensates property owners for lost rental income due to damage to their leased property, while business income coverage protects business owners from lost revenue resulting from the interruption of their business operations.

What types of events are covered by business income coverage?

Business income coverage typically covers events such as fires, windstorms, hail, civil unrest, and floods.

How do I determine the appropriate coverage amount for business income coverage?

Calculate the potential financial loss your business could face in the event of a covered event. Consider factors such as lost sales, ongoing expenses, and relocation costs.

What documentation should I submit to support a business income coverage claim?

Provide financial records, proof of lost income, and any other documentation requested by your insurance company to support your claim.