Distribution Eligibility For Delaware Limited Liability Companies: A Comprehensive Guide

Understanding the Distribution Eligibility Requirements

KPMG Holiday Greeting | Traditions KPMG Holiday Greeting – Source view.ceros.com

It’s a common misconception that all members of a Delaware limited liability company (LLC) are automatically entitled to receive distributions. In reality, the eligibility for distributions is subject to several factors, including the LLC’s operating agreement and the Delaware Limited Liability Company Act.

Determining Eligibility Criteria

One Towercreek – Triad Properties – Source triadproperties.com

The LLC’s operating agreement is the primary document that governs the distribution of profits and losses among the members. It typically specifies the criteria for determining which members are eligible to receive distributions and the method for calculating their respective shares. In the absence of a specific provision in the operating agreement, the Delaware Limited Liability Company Act provides default rules for distribution eligibility.

Main Points on Distribution Eligibility

6 Key Characteristics of Limited Liability Companies (LLC) – Source investinasia.id

– Distribution eligibility is determined by the LLC’s operating agreement and the Delaware Limited Liability Company Act.

– The operating agreement can specify the criteria for determining eligibility and the method for calculating distributions.

– In the absence of a specific provision in the operating agreement, the Delaware Limited Liability Company Act provides default rules for distribution eligibility.

Target of Distribution Eligibility

CITY – Rebecca de Ravenel LLC, A Delaware Limited Liability Company – Source rebeccaderavenel.com

The ultimate target of distribution eligibility for Delaware LLCs is to ensure that distributions are made in accordance with the intentions of the members and in compliance with applicable law. By clearly defining the eligibility criteria in the operating agreement, LLCs can avoid disputes and ensure the fair and equitable distribution of profits and losses among their members.

Distribution Eligibility for Delaware LLCs: A Personal Experience

My Journey as a Member of a Delaware LLC

Limited Liability Companies – Corporations A corporation is an – Source www.studocu.com

As a member of a Delaware LLC, I was initially unsure of my eligibility for distributions. However, upon reviewing the operating agreement, I discovered that I was eligible to receive distributions based on my percentage ownership interest in the LLC. This provided me with a clear understanding of my rights and expectations as a member of the LLC.

Understanding Distribution Eligibility

The Legal Framework for Distribution Rights

Newpoint Commons 300 – Triad Properties – Source triadproperties.com

In addition to the operating agreement, the Delaware Limited Liability Company Act provides further guidance on distribution eligibility. Section 18-1106 of the Act states that distributions may be made to members on the basis of their respective capital contributions, their respective interests in the profits and losses of the LLC, or any other reasonable basis.

Historical Context of Distribution Eligibility

Evolution of Legal Precedents

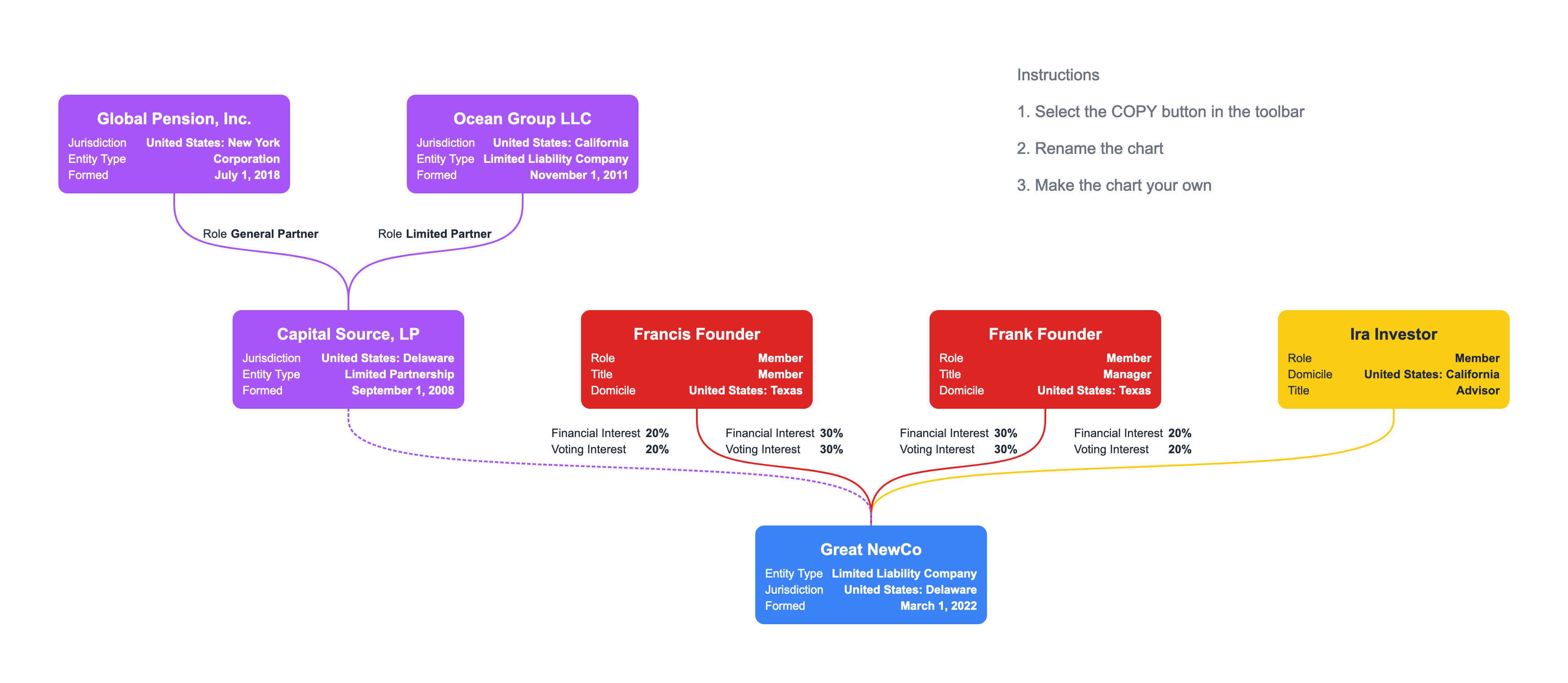

Show LLC company structure with this free chart template – Source lexchart.com

The concept of distribution eligibility has evolved over time, with courts interpreting the Delaware Limited Liability Company Act to provide clarity on this issue. In the landmark case of In re Farmers Market of Georgetown, LLC, the Delaware Court of Chancery held that the LLC’s operating agreement governed the distribution of profits and losses, and that members were not entitled to equal distributions simply by virtue of their membership.

Hidden Secrets of Distribution Eligibility

Unveiling the Nuanced Aspects

slide1 – Source www.sec.gov

Beyond the basic principles of distribution eligibility, there are often hidden nuances to consider. For example, the operating agreement may provide for different distribution rules for different classes of members. It is important to carefully review the operating agreement and seek legal advice if necessary to fully understand the distribution eligibility provisions that apply to your LLC.

Recommendations for Optimizing Distribution Eligibility

Strategies for Effective Distribution Policies

Legal Intelligencer: Significant Recent Changes to the Delaware Limited – Source www.khflaw.com

To optimize distribution eligibility, it is recommended to:

– Draft a clear and comprehensive operating agreement that specifically addresses distribution eligibility.

– Consider the different classes of members and their respective rights and responsibilities.

– Regularly review and update the operating agreement as needed to ensure that it remains aligned with the LLC’s business goals and legal requirements.

Distribution Eligibility and Complying with Delaware Law

The Benefits Available Through the Incorporation of Nevis International – Source globalreferral.group

It is crucial for Delaware LLCs to comply with the distribution eligibility provisions of the Delaware Limited Liability Company Act. Failure to do so may result in legal challenges and potential liability for the LLC and its members.

Tips for Managing Distribution Eligibility Effectively

Practical Guidance for Distribution Management

To effectively manage distribution eligibility, consider the following tips:

– Maintain accurate records of member ownership interests and capital contributions.

– Prepare regular financial statements to track the LLC’s profits and losses.

– Hold regular member meetings to discuss and approve distribution resolutions.

Distribution Eligibility: A Key Component of LLC Governance

Distribution eligibility is a fundamental aspect of LLC governance, as it determines the rights of members to receive distributions and the manner in which distributions are made. By understanding the distribution eligibility rules and implementing sound distribution policies, LLCs can ensure that distributions are made fairly and in compliance with applicable law.

Fun Facts about Distribution Eligibility in Delaware LLCs

Interesting Trivia and Quirks

– Delaware LLCs have great flexibility in determining distribution eligibility criteria, allowing them to tailor their distributions to meet their specific needs.

– The Delaware Limited Liability Company Act provides for default distribution rules in the absence of a specific provision in the operating agreement, ensuring that distributions are made in a fair and equitable manner.

How to File for Distribution Eligibility as a Delaware LLC

Step-by-Step Guide to Eligibility Determination

To file for distribution eligibility as a Delaware LLC, follow these steps:

1. Review the LLC’s operating agreement to determine the distribution eligibility criteria.

2. Prepare a resolution requesting distribution eligibility, specifying the amount and method of distribution.

3. Submit the resolution to the LLC’s governing body for approval.

4. Once approved, file the resolution with the Delaware Division of Corporations.

What If You’re Denied Distribution Eligibility in a Delaware LLC?

Understanding Your Options and Legal Remedies

If you are denied distribution eligibility in a Delaware LLC, you may consider the following options:

– Review the LLC’s operating agreement to confirm whether you meet the eligibility criteria.

– Discuss the matter with the LLC’s management and seek a resolution.

– Consult with an attorney to explore your legal rights and potential remedies, such as filing a lawsuit to enforce your distribution rights.

Listicle: Key Considerations for Distribution Eligibility

Essential Factors to Keep in Mind

– The operating agreement governs the distribution eligibility criteria.

– The Delaware Limited Liability Company Act provides default distribution rules.

– Different classes of members may have varying distribution rights.

– LLCs can tailor their distribution policies to meet their specific needs.

– Complying with Delaware law is crucial for distribution eligibility.

Question and Answer

Conclusion of Distribution Eligibility for Delaware Limited Liability Companies

Distribution eligibility is a fundamental aspect of Delaware LLCs, determining the rights of members to receive distributions. By understanding the distribution eligibility rules and implementing sound distribution policies, LLCs can ensure that distributions are made fairly and in compliance with applicable law.

![Crisis Averted: [Company Name] Responds Swiftly To Address [Issue Name] Crisis Averted: [Company Name] Responds Swiftly To Address [Issue Name]](https://s3.castbox.fm/b9/32/14/4859554072ac1afe4465dd35a3.jpg)