ESG Investing: Transforming the Financial Landscape for a Sustainable Future

In today’s rapidly evolving world, investors are increasingly recognizing the importance of environmental, social, and governance (ESG) factors in evaluating investment opportunities. ESG: Shaping Tomorrow’s Investment Landscape explores the growing demand for ESG-focused investments and their profound impact on shaping the future of finance.

Aura Investment Platform – Honest Design Portfolio – Source honestdesign.co.nz

Challenges and Opportunities

As we navigate an era of increasing climate-related risks, social inequality, and geopolitical volatility, investors are actively seeking opportunities to align their portfolios with their values and contribute to positive change. ESG metrics provide a framework to assess companies’ commitment to sustainability, social responsibility, and ethical governance, offering potential for both financial returns and societal impact.

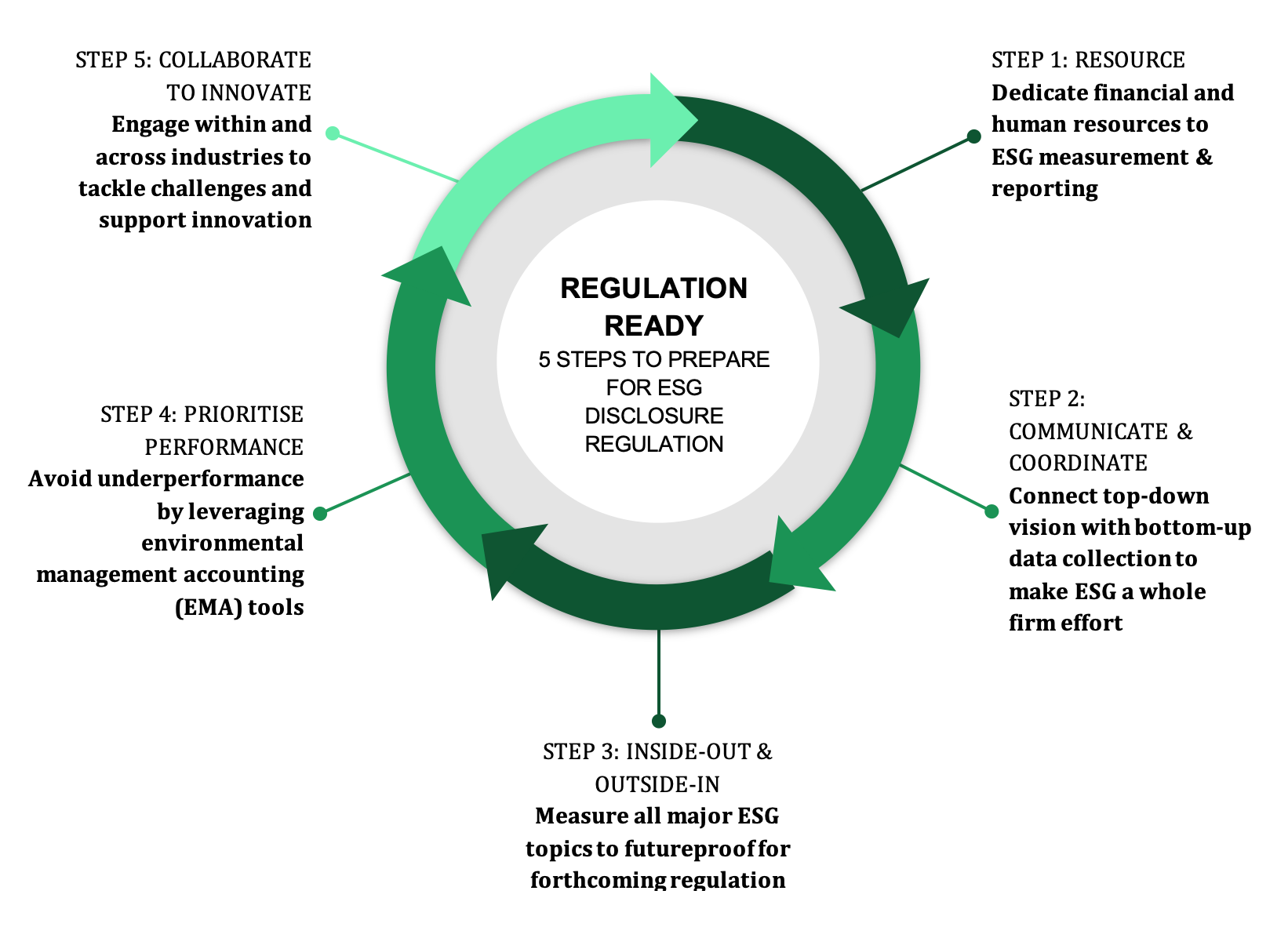

The Regulation Revolution: How Firms Can Prepare for ESG Disclosure – Source cmr.berkeley.edu

ESG: Driving Sustainable Value

ESG investments prioritize companies with strong environmental stewardship, equitable labor practices, and transparent governance structures. These factors have been shown to enhance long-term financial performance by reducing risks, improving operational efficiency, and fostering customer loyalty. By embracing ESG principles, investors not only contribute to sustainability but also unlock potential for positive returns.

Environmental, Social, Governance (ESG) Investing Approach, 41% OFF – Source www.micoope.com.gt

Understanding ESG: Pillars and Measurements

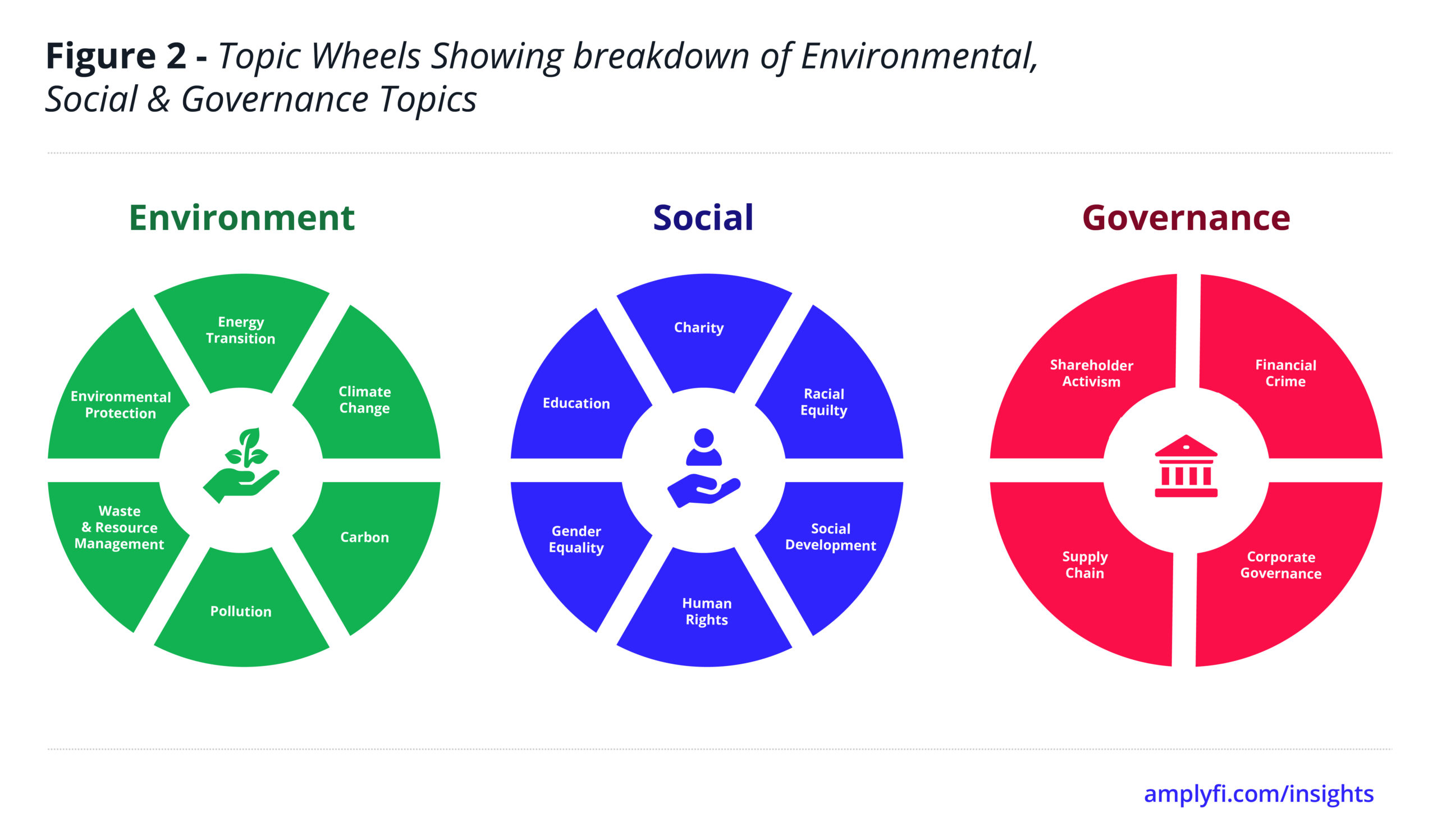

ESG incorporates a wide range of factors assessed through qualitative and quantitative measures. Environmental criteria include emissions reduction, water management, and waste minimization. Social aspects encompass labor rights, community engagement, and diversity. Governance considers board structure, executive compensation, and shareholder rights. By evaluating companies across these dimensions, investors can make informed decisions that align with their values and investment goals.

Clean Hydrogen Shaping Tomorrow’s Energy Landscape – Green Hydrogen News – Source energynews.biz

The History and Evolution of ESG

ESG investing has its roots in the socially responsible investment movement of the 1960s. Over time, it has evolved from a niche approach to a mainstream investment strategy. Today, major investment firms and institutional investors incorporate ESG factors into their decision-making, driven by growing demand from both individual and institutional investors.

Krung Thai Asset Management Launches Thai ESG Fund Group for – Source www.newsdirectory3.com

Unveiling the Hidden Benefits of ESG

ESG investments offer a range of benefits beyond financial returns. They can mitigate risks associated with environmental disasters, social unrest, and corporate scandals. ESG-focused companies often have better risk management practices, stronger employee morale, and improved brand reputation. By investing in ESG, individuals and institutions can contribute to a more sustainable and equitable world while potentially enhancing their investment performance.

ESG Remains Crucial To Building A Sustainable Future – Forbes Asia Custom – Source forbesasiacustom.com

Recommendations for ESG Investing

To effectively incorporate ESG into investment portfolios, consider the following recommendations: 1) Define your ESG goals and values; 2) Conduct thorough research on potential investments; 3) Engage with companies to understand their ESG practices; 4) Diversify your ESG portfolio across industries and sectors; 5) Monitor and evaluate your investments regularly to ensure alignment with your ESG values.

Innovative technology and how it is shaping our future | Insights – Source weareprimegroup.com

The Role of ESG in Enhancing Investment Returns

Numerous studies have demonstrated a positive correlation between ESG performance and financial returns. Companies with strong ESG practices tend to exhibit superior risk-adjusted performance, increased shareholder value, and reduced volatility. By incorporating ESG factors, investors can potentially enhance their investment returns while contributing to a sustainable future.

What is ESG and why is it important – Midas PR – Source www.midas-pr.com

Tips for Successful ESG Investing

To maximize the benefits of ESG investing, follow these tips: 1) Seek professional guidance if needed; 2) Use ESG-specific investment tools and resources; 3) Stay informed about ESG trends and regulations; 4) Encourage companies to improve their ESG performance; 5) Exercise your shareholder rights to promote ESG practices. By embracing these principles, you can navigate the ESG landscape effectively.

The Evolution of ESG Investing: From Ethical Concern to Corporate Value – Source www.tkfd.or.jp

ESG: A Catalyst for Positive Change

ESG investing is not just an investment strategy; it’s a powerful tool for shaping a more sustainable, socially responsible, and economically equitable world. By directing capital towards companies that prioritize ESG, investors can drive positive change across industries, promote innovation, and create a better future for generations to come.

Archive Newsletter | ashraesocal – Source www.ashrae-socal.org

Fun Facts about ESG Investing

Here are some intriguing facts about ESG investing: 1) The global ESG market is projected to reach $53 trillion by 2025; 2) ESG-focused funds have outperformed traditional funds during periods of market volatility; 3) Millennials and Gen Z investors are increasingly interested in ESG investments; 4) Many countries and companies have adopted ESG reporting frameworks to enhance transparency and accountability; 5) ESG investing is not only for large investors; individuals can also make a positive impact through ESG-focused savings accounts, mutual funds, and exchange-traded funds (ETFs).

How to Get Started with ESG Investing

To get started with ESG investing, consider the following steps: 1) Educate yourself about ESG factors and investment strategies; 2) Identify your financial goals and risk tolerance; 3) Explore ESG-focused investment options; 4) Diversify your portfolio across ESG-compliant companies; 5) Monitor your investments and engage with companies to advocate for ESG practices. By following these steps, you can harness the power of ESG investing to make a meaningful impact on the world while potentially enhancing your financial well-being.

What if ESG Investing Doesn’t Achieve its Goals?

While ESG investing has shown promising results, there’s always the possibility that it may not fully achieve its intended goals. Factors such as greenwashing, inconsistent ESG reporting standards, and slow adoption by some industries could hinder progress. However, the creciente demand for ESG-focused investments, coupled with increased regulatory oversight and consumer awareness, suggests that ESG is here to stay. By staying informed and engaging with companies, investors can contribute to the evolution and effectiveness of ESG investing.

A Listicle of Essential ESG Investing Tips

Here’s a concise listicle of essential ESG investing tips: 1) Set clear ESG goals and values; 2) Conduct thorough research on potential investments; 3) Diversify your portfolio across industries and sectors; 4) Seek professional guidance if needed; 5) Engage with companies to promote ESG practices; 6) Stay informed about ESG trends and regulations; 7) Encourage companies to improve their ESG performance; 8) Use ESG-specific investment tools and resources; 9) Exercise your shareholder rights to promote ESG practices; 10) Be patient and persistent in your ESG investing journey.

Questions and Answers about ESG: Shaping Tomorrow’s Investment Landscape

Q: Why is ESG investing becoming so popular?

A: Investors are increasingly recognizing the importance of environmental, social, and governance factors in driving long-term financial performance and creating a sustainable future.

Q: How can I incorporate ESG into my investment portfolio?

A: Consider your investment goals, research ESG-compliant companies, diversify your portfolio, and engage with companies to advocate for ESG practices.

Q: Is ESG investing only for large investors?

A: No, individuals can also invest in ESG-focused savings accounts, mutual funds, and exchange-traded funds (ETFs).

Q: What are the challenges in ESG investing?

A: Greenwashing, inconsistent ESG reporting standards, and the potential for companies to prioritize profits over ESG goals are some challenges in ESG investing.

Conclusion of ESG: Shaping Tomorrow’s Investment Landscape

ESG: Shaping Tomorrow’s Investment Landscape has emerged as a transformative force in the world of finance. By incorporating ESG factors into investment decisions, investors can not only pursue financial returns but also contribute to a more sustainable, socially responsible, and equitable world. As ESG investing continues to gain momentum, it is poised to play a pivotal role in shaping the future of our planet and our financial markets.