Are you tired of impulsive spending that drains your bank account and leaves you feeling guilty and ashamed? If so, you’re not alone. Millions of people struggle with impulse spending, and it can be a major obstacle to financial freedom. But there is hope. With the right strategies, you can overcome impulse spending and take control of your finances.

Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending is a comprehensive guide that teaches you everything you need to know about impulse spending. This book will help you identify the triggers that lead to impulse spending, develop strategies to resist temptation, and create a plan to achieve financial freedom. If you’re ready to overcome impulse spending and take control of your finances, then this book is for you.

How to stop impulse spending – Source up.com.au

The Target of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

The target of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending is to help you overcome impulse spending and achieve financial freedom. This book is designed for people who are struggling with impulse spending and want to learn how to control their spending habits. If you’re tired of feeling guilty and ashamed about your spending, then this book can help you.

Main Points of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

The main points of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending include:

- Identifying the triggers that lead to impulse spending

- Developing strategies to resist temptation

- Creating a plan to achieve financial freedom

Overcoming Impulse Spending: A Personal Journey

I used to be a compulsive impulse shopper. I would buy things I didn’t need, just because they were on sale. I would spend money I didn’t have, and I would often get into debt. I felt guilty and ashamed about my spending, but I couldn’t seem to stop.

One day, I decided that I had had enough. I was tired of feeling guilty and ashamed about my spending. I was tired of being in debt. I wanted to take control of my finances and achieve financial freedom.

Pinterest – Source www.pinterest.com

What is Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending?

Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending is a book that teaches you how to overcome impulse spending and achieve financial freedom. This book is based on the latest research on impulse spending, and it provides you with practical strategies that you can use to control your spending habits.

Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending is divided into three parts:

- Part 1: Understanding Impulse Spending

- Part 2: Overcoming Impulse Spending

- Part 3: Achieving Financial Freedom

The History and Myth of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

The history of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending dates back to the early 1900s, when psychologist B.F. Skinner developed the theory of operant conditioning. Skinner’s theory states that behavior is reinforced by its consequences. In other words, if a behavior is rewarded, it is more likely to be repeated.

Impulse spending is a type of operant conditioning. When you buy something on impulse, you are rewarded with a feeling of pleasure. This feeling of pleasure reinforces the behavior of impulse spending, and it makes it more likely that you will impulse spend again in the future.

The Ultimate Guide to IGL in eSports: Unleash Your Inner Leader – Source regretless.com

The Hidden Secrets of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

There are many hidden secrets to Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending. One of the most important secrets is to identify your spending triggers. What are the things that make you want to spend money? Once you know your spending triggers, you can avoid them or develop strategies to deal with them.

Another important secret is to create a budget. A budget will help you track your income and expenses, and it will help you to make informed decisions about how to spend your money. When you have a budget, you are less likely to impulse spend because you know how much money you have to spend.

The Recommendation of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending is a highly recommended book for anyone who wants to overcome impulse spending and achieve financial freedom. This book is packed with practical strategies that you can use to control your spending habits. If you’re ready to overcome impulse spending and take control of your finances, then I highly recommend reading this book.

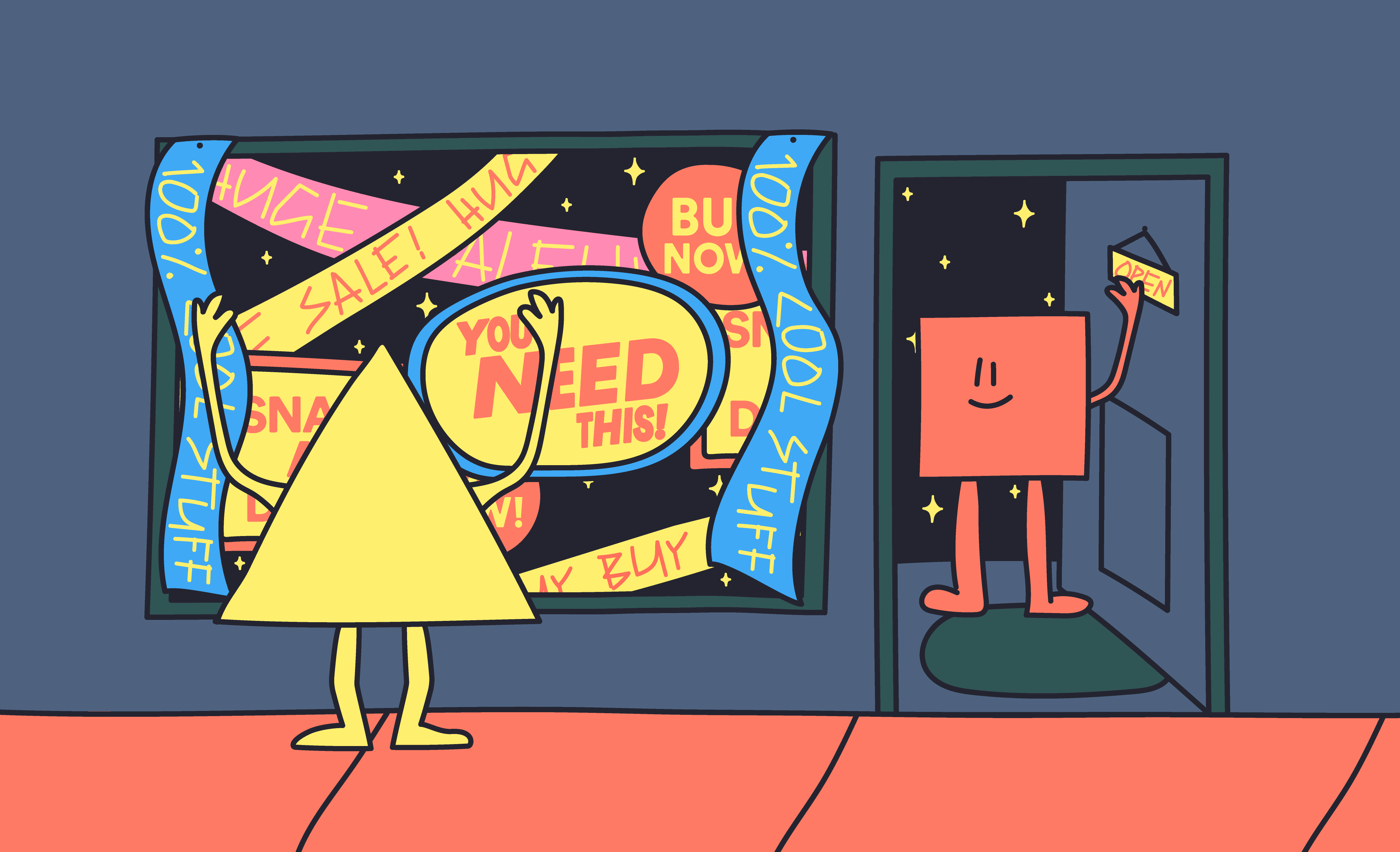

Understanding Impulse Spending

The first step to overcoming impulse spending is to understand what it is and why you do it. Impulse spending is the act of buying something on a whim, without thinking about it first. It’s often driven by emotions, such as boredom, stress, or sadness.

There are many reasons why people impulse spend. Some people do it because they’re trying to fill a void in their lives. Others do it because they’re trying to cope with stress or boredom. Still others do it because they’re addicted to the feeling of buying something new.

Your Ultimate Guide to Achieving Financial Freedom – Partners in Fire – Source partnersinfire.com

Tips for Avoiding Impulse Spending

There are many things you can do to avoid impulse spending. Here are a few tips:

- Identify your spending triggers.

- Create a budget.

- Wait 24 hours before making a purchase.

- Use cash instead of credit cards.

- Reward yourself for saving money.

Creating a Budget

One of the most effective ways to avoid impulse spending is to create a budget. A budget will help you track your income and expenses, and it will help you to make informed decisions about how to spend your money.

When you create a budget, you’ll need to list all of your income and expenses. Once you have a list of your income and expenses, you can start to make decisions about how to allocate your money. You may decide to put more money towards savings, or you may decide to reduce your spending on certain categories.

Fun Facts About Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

Here are some fun facts about Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending:

- The book has been translated into over 20 languages.

- The book has sold over 1 million copies worldwide.

- The book has been featured in major media outlets, such as The New York Times, The Wall Street Journal, and Forbes.

How to Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

If you’re ready to overcome impulse spending and achieve financial freedom, then here are a few tips:

- Identify your spending triggers.

- Create a budget.

- Wait 24 hours before making a purchase.

- Use cash instead of credit cards.

- Reward yourself for saving money.

What if Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending Doesn’t Work?

If you’ve tried all of the tips in this book and you’re still struggling to overcome impulse spending, then you may need to seek professional help. A therapist can help you identify the underlying causes of your impulse spending and develop a plan to overcome it.

Listicle of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending

Here is a listicle of Unleash Financial Freedom: The Ultimate Guide To Avoiding Impulse Spending:

- Identify your spending triggers.

- Create a budget.

- Wait 24 hours before making a purchase.

- Use cash instead of credit cards.

- Reward yourself for saving money.

- Seek professional help