Are you struggling to make ends meet? Do you feel like your money is always slipping through your fingers? If so, you may be a victim of reckless spending. Reckless spending can burn a hole in your pocket and leave you with nothing to show for it. In this blog post, we will explore the causes of reckless spending and offer tips on how to get your spending under control.

Unveiling the Financial Drain

Reckless spending is a serious problem that can have a devastating impact on your financial health. It can lead to debt, bankruptcy, and even homelessness. If you are struggling with reckless spending, it is important to seek help immediately.

What is Reckless Spending?

Reckless spending is characterized by impulsive purchases, excessive debt, and a lack of financial planning. People who spend recklessly often do not have a budget, and they may not be aware of how much they are spending. They may also be using credit cards to finance their purchases, which can lead to high interest rates and fees.

Unveiling the Financial Drain: How Reckless Spending Can Burn A Hole In Your Pocket

Unveiling the Financial Drain: How Reckless Spending Can Burn A Hole In Your Pocket is a comprehensive guide to help you understand the causes of reckless spending and how to get your spending under control. This book provides practical tips and advice that can help you achieve your financial goals.

In this book, you will learn:

- The causes of reckless spending

- The signs and symptoms of reckless spending

- How to create a budget and stick to it

- How to manage your debt

- How to save for the future

If you are struggling with reckless spending, this book is a valuable resource that can help you get back on track.

Kreg R3 Jr. Pocket Hole Jig System (Jig System)- Buy Online in United – Source www.desertcart.ae

Unveiling the Financial Drain: How Reckless Spending Can Burn A Hole In Your Pocket

Unveiling the Financial Drain: How Reckless Spending Can Burn A Hole In Your Pocket is a powerful book that can help you transform your relationship with money. This book will teach you how to:

- Identify the emotional triggers that lead to reckless spending

- Develop healthy spending habits

- Create a budget that works for you

- Get out of debt and stay out of debt

- Build a secure financial future

If you are ready to take control of your finances, this book is a must-read.

Download Burn Hole Png Transparent Burnt Paper Png Pn – vrogue.co – Source www.vrogue.co

Unveiling the Financial Drain: The History and Myth

The history of reckless spending dates back to the early days of consumerism. In the 19th century, the Industrial Revolution led to a dramatic increase in the production of goods and services. This, in turn, led to a rise in consumer spending. However, many people did not have the financial literacy to manage their spending wisely, and they fell into debt.

In the 20th century, the problem of reckless spending only got worse. The advent of credit cards made it easier than ever to borrow money. This led to a surge in consumer debt, and many people found themselves overwhelmed by their monthly payments.

Burnt Paper Hole – Source ar.inspiredpencil.com

Unveiling the Financial Drain: The Hidden Secret

The hidden secret of reckless spending is that it is a form of self-sabotage. When you spend money recklessly, you are not only harming your financial health, but you are also damaging your self-esteem. Reckless spending can lead to feelings of guilt, shame, and anxiety.

If you are struggling with reckless spending, it is important to seek help. There are many resources available to help you get your spending under control. You can also talk to a therapist to help you understand the emotional triggers that lead to reckless spending.

Sajid Javid slams John McDonnells 1.2trillion reckless Labour spending – Source hellofaread.com

Unveiling the Financial Drain: The Recommendation

The best way to prevent reckless spending is to create a budget. A budget will help you track your income and expenses so that you can make informed decisions about how to spend your money. It is also important to avoid using credit cards to finance your purchases. If you do use credit cards, be sure to pay off your balance in full each month.

If you are struggling to get your spending under control, you may want to seek professional help. A financial advisor can help you create a budget, manage your debt, and save for the future.

John Boehner Calls Ted Cruz a ‘Reckless A**hole’ in New Book Excerpt – Source www.newsweek.com

Unveiling the Financial Drain: The Explanation

Reckless spending is a serious problem that can have a devastating impact on your financial health. It is important to understand the causes of reckless spending and to take steps to get your spending under control. If you are struggling with reckless spending, do not be afraid to seek help.

Unveiling the Financial Drain: The Tips

Here are a few tips to help you get your spending under control:

- Create a budget and stick to it.

- Avoid using credit cards to finance your purchases.

- Pay off your credit card balance in full each month.

- Save for the future.

- Seek professional help if you are struggling to get your spending under control.

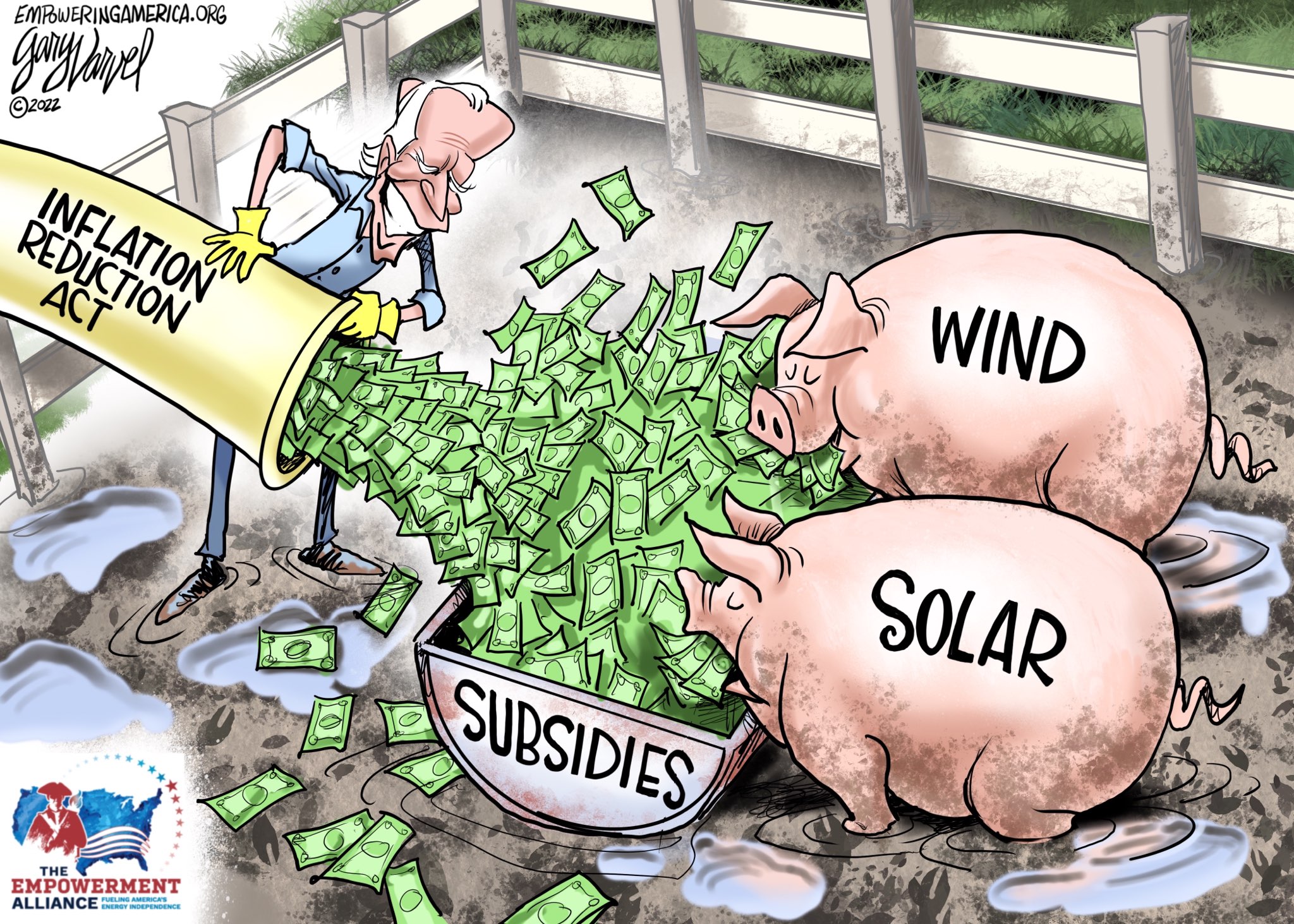

Death, Taxes, and Reckless Spending – TEA – Source empoweringamerica.org

Unveiling the Financial Drain: The Details

Reckless spending can be a difficult problem to overcome, but it is not impossible. By following these tips, you can get your spending under control and achieve your financial goals.

Unveiling the Financial Drain: The Fun Facts

Here are a few fun facts about reckless spending:

- Reckless spending is a major cause of bankruptcy.

- People who spend recklessly are more likely to experience financial stress and anxiety.

- Reckless spending can damage your relationships.

Pin en Imágenes divertidas – Source www.pinterest.com

Unveiling the Financial Drain: The How-To

If you are ready to get your spending under control, follow these steps:

- Create a budget.

- Track your income and expenses.

- Identify areas where you can cut back on spending.

- Make a plan to pay off your debt.

- Start saving for the future.

Unveiling the Financial Drain: The What-If

What if you could get your spending under control? What would that mean for your life? You would have more money to save for the future. You would be less stressed about money. You would have more financial freedom.

Getting your spending under control is not easy, but it is worth it. If you are ready to take control of your finances, follow the tips in this blog post.

Don’t Give Your Child Too Much Credit for Knowing How to Handle Money – Source collegefinancialaidadvisors.com

Unveiling the Financial Drain: The Listicle

Here is a listicle of the benefits of getting your spending under control:

- You will have more money to save for the future.

- You will be less stressed about money.

- You will have more financial freedom.

- You will be able to achieve your financial goals.

- You will be happier and more fulfilled.

Questions and Answers

- What is reckless spending?

- What are the causes of reckless spending?

- What are the signs and symptoms of reckless spending?

- How can I get my spending under control?

Conclusion of Unveiling the Financial Drain: How Reckless Spending Can Burn A Hole In Your Pocket

Reckless spending is a serious problem, but it is one that can be overcome. By following the tips in this blog post, you can get your spending under control and achieve your financial goals.

![Crisis Averted: [Company Name] Responds Swiftly To Address [Issue Name] Crisis Averted: [Company Name] Responds Swiftly To Address [Issue Name]](https://s3.castbox.fm/b9/32/14/4859554072ac1afe4465dd35a3.jpg)