Do you have concerns about your shareholder rights and potential corporate misconduct? Shareholder derivative lawsuits provide a mechanism for shareholders to protect their interests in certain circumstances. In this comprehensive guide, we’ll delve into the basics of shareholder derivative lawsuits, exploring their targets, history, and key details.

Defending Shareholder Derivative Actions in Florida – PFHG – Source www.pfhglaw.com

Shareholder derivative lawsuits arise when a shareholder believes the company’s board of directors or executives have breached their fiduciary duties. Shareholders may seek to bring a lawsuit on behalf of the corporation to recover damages or secure corrective action. These lawsuits can address various corporate wrongdoings like self-dealing, mismanagement, fraud, and violations of the law.

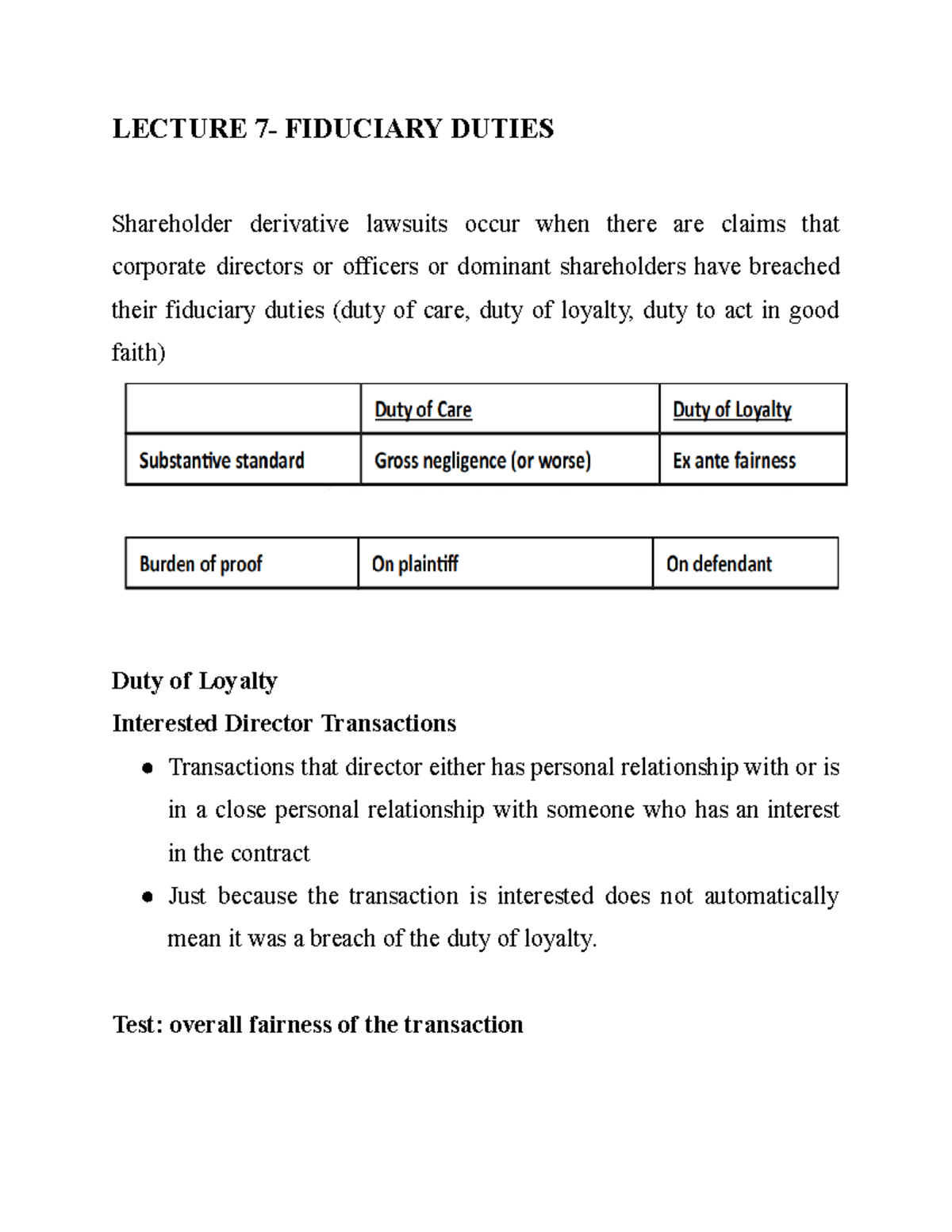

C0-7 – Lecture notes 7 – LECTURE 7- FIDUCIARY DUTIES Shareholder – Source www.studocu.com

Target of Shareholder Derivative Lawsuits: Overview And Analysis

Shareholder derivative lawsuits target individuals or entities within the corporation, such as board members, officers, and controlling shareholders. The lawsuit is brought on behalf of the corporation itself, alleging that their actions or omissions have harmed the company and its shareholders. The lawsuit seeks to hold these parties accountable and recover damages or other relief for the benefit of the corporation.

Different Approaches to Shareholder Advocacy – Source bostoncommonasset.com

Main Points of Shareholder Derivative Lawsuits: Overview And Analysis

Shareholder derivative lawsuits play a crucial role in ensuring corporate accountability and protecting shareholder rights. They allow shareholders to hold those responsible for corporate misconduct to account and recover damages on behalf of the company. The process can be complex and requires careful consideration of various factors, including standing, demand requirements, and the specific allegations of wrongdoing.

Shareholder Derivative Lawsuits: Pre-Filing Requirements – Reid & Hellyer – Source rhlaw.com

Shareholder Derivative Lawsuits: Overview And Analysis and Its Target

Shareholder Derivative Lawsuits: Overview And Analysis

Shareholder derivative lawsuits are a legal mechanism that enables shareholders to bring an action on behalf of a corporation against its directors, officers, or other third parties for alleged wrongdoing that has harmed the company. These lawsuits are typically initiated when the company’s board of directors fails or refuses to take action against the responsible parties.

Majority Shareholder vs. Minority Shareholder Challenges | Jimerson Birr – Source www.jimersonfirm.com

The target of a shareholder derivative lawsuit is to recover damages for the corporation and its shareholders. The lawsuit aims to hold the responsible parties accountable for their actions and prevent similar misconduct in the future. If successful, the lawsuit may result in monetary damages, injunctions, or other remedies that benefit the corporation.

Shareholder Derivative Lawsuits: Overview And Analysis and Its Explanation

Shareholder Derivative Lawsuits: Overview And Analysis

Shareholder derivative lawsuits are a complex and highly regulated area of law. The requirements and procedures for filing and pursuing such lawsuits vary from jurisdiction to jurisdiction. In general, shareholders must meet certain standing requirements to bring a derivative lawsuit, such as owning a certain number of shares or having held their shares for a specific period.

Breach of Shareholder Agreements | Jimerson Birr – Source www.jimersonfirm.com

Shareholders must also make a demand on the board of directors to take action before filing a derivative lawsuit. This demand gives the board an opportunity to investigate the allegations and take appropriate action, if warranted. If the board fails or refuses to act, the shareholder may then proceed with the lawsuit.

Shareholder Derivative Lawsuits: Overview And Analysis and Its History

Shareholder Derivative Lawsuits: Overview And Analysis

The origins of shareholder derivative lawsuits can be traced back to the common law of England. Historically, shareholders had limited rights to bring actions against their companies. In the 19th century, courts began to recognize the need for a mechanism to allow shareholders to hold directors and officers accountable for misconduct.

Seven Shareholder Derivative Lawsuits Seek Diversity on Corporate – Source rennepubliclawgroup.com

The first modern shareholder derivative lawsuit was filed in the United States in 1892. Since then, derivative lawsuits have become a common tool for shareholders to protect their interests and enforce corporate accountability. Today, shareholder derivative lawsuits are an essential part of the corporate governance landscape.

Shareholder Derivative Lawsuits: Overview And Analysis and Its Hidden Secret

Shareholder Derivative Lawsuits: Overview And Analysis

One of the hidden secrets of shareholder derivative lawsuits is their potential for significant recoveries. In some cases, derivative lawsuits have resulted in settlements or judgments worth billions of dollars. This is because derivative lawsuits allow shareholders to aggregate their claims and pursue them on behalf of the entire company.

How to Draft an Answer to a Debt Collection Lawsuit in Kentucky – Source brackneylaw.com

Another hidden secret of derivative lawsuits is that they can be used to force companies to change their behavior. Even if a lawsuit does not result in a monetary recovery, it can still be successful in achieving corporate reforms or deterring future misconduct.

Shareholder Derivative Lawsuits: Overview And Analysis and Its Recommendation

Shareholder Derivative Lawsuits: Overview And Analysis

If you are considering filing a shareholder derivative lawsuit, it is important to consult with an experienced attorney. Derivative lawsuits are a complex area of law, and it is essential to have qualified legal counsel to guide you through the process.

Analysis: Fed report on SVB collapse could buoy shareholder lawsuits – Source fism.tv

An attorney can help you assess the merits of your case, determine your standing, and navigate the legal requirements. They can also represent you in court and negotiate a favorable settlement or judgment on your behalf.

Shareholder Derivative Lawsuits: Overview And Analysis Explained

Shareholder derivative lawsuits are a powerful tool for shareholders to protect their rights and hold corporate wrongdoers accountable. By understanding the basics of derivative lawsuits, you can be better equipped to make informed decisions about your shareholder rights and the potential remedies available to you.

Shareholder Derivative Lawsuits | Jimerson Birr – Source www.jimersonfirm.com

Shareholder Derivative Lawsuits: Overview And Analysis and Its Tips

Shareholder Derivative Lawsuits: Overview And Analysis

Here are a few additional tips for shareholders who are considering filing a derivative lawsuit:

1. Do your research. Before you file a lawsuit, it is important to do your research and understand the facts of the case. This includes reviewing the company’s financial statements, SEC filings, and other relevant documents.

2. Get legal advice. As mentioned above, it is important to consult with an experienced attorney before filing a shareholder derivative lawsuit. An attorney can help you assess the merits of your case and guide you through the legal process.

3. Be prepared for a long process. Shareholder derivative lawsuits can be complex and time-consuming. It is important to be prepared for a long process and to be patient throughout the duration of the lawsuit.

Shareholder Derivative Lawsuits: Overview And Analysis in Detail

For more information on shareholder derivative lawsuits, please consult the following resources:

- The Securities and Exchange Commission (SEC): https://www.sec.gov/divisions/enforcement/shareholder-derivative-actions

- The American Bar Association (ABA): https://www.americanbar.org/groups/business_law/publications/blt/2017/05/01_shareholder-derivative-lawsuits-overview-of-key-issues/

- The Council of Institutional Investors (CII): https://www.cii.org/pdf/2014_CII_Shareholder_Derivative_Litigation_Study.pdf

Shareholder Derivative Lawsuits: Overview And Analysis and Its Fun Facts

Shareholder Derivative Lawsuits: Overview And Analysis

Here are a few fun facts about shareholder derivative lawsuits:

1. The largest shareholder derivative lawsuit settlement ever was for $7.2 billion, paid by Volkswagen in 2017.

2. Shareholder derivative lawsuits are more common in the United States than in other countries.

3. Shareholder derivative lawsuits can be used to challenge a wide range of corporate misconduct, including fraud, self-dealing, and breaches of fiduciary duty.

Shareholder Derivative Lawsuits: Overview And Analysis and Its How To

Shareholder Derivative Lawsuits: Overview And Analysis

If you are considering filing a shareholder derivative lawsuit, you should follow these steps:

1. Gather evidence of the alleged wrongdoing.

2. Consult with an attorney to discuss your case.

3. File a complaint with the court.

4. Serve the complaint on the defendant.

5. Participate in discovery.

6. Go to trial.

Shareholder Derivative Lawsuits: Overview And Analysis and Its What If

Shareholder Derivative Lawsuits: Overview And Analysis

Here are some common questions about shareholder derivative lawsuits:

- What if I don’t have enough money to file a lawsuit?