Have you ever wondered what happens when a company’s management team makes decisions that are not in the best interests of the shareholders? Landmark shareholder derivative suits are a powerful tool that can be used to hold these executives accountable.

Landmark Shareholder Derivative Suits: A Growing Trend

In recent years, there has been a growing trend of shareholder derivative suits being filed against companies. This is due in part to the increased awareness of shareholder rights, as well as the increasing willingness of shareholders to hold companies accountable for their actions.

Shareholder Derivative Suits — San Jose Business Lawyers Blog — April 2 – Source www.sanjosebusinesslawyersblog.com

The Purpose of Landmark Shareholder Derivative Suits

The purpose of a shareholder derivative suit is to allow shareholders to bring a lawsuit on behalf of the company when the company itself is unable or unwilling to do so. This can happen when the company’s management team is involved in the alleged wrongdoing, or when the company is otherwise unable to protect the interests of its shareholders.

Shareholder Derivative Action Suits in India – Avoiding the Influence – Source www.studocu.com

Landmark Shareholder Derivative Suits: A Powerful Tool

The Target of Landmark Shareholder Derivative Suits

The target of a shareholder derivative suit is typically the company’s management team. However, other parties, such as outside directors or auditors, may also be named as defendants.

What is a shareholder derivative lawsuit? Elon Musk sued by heavy metal – Source www.sportskeeda.com

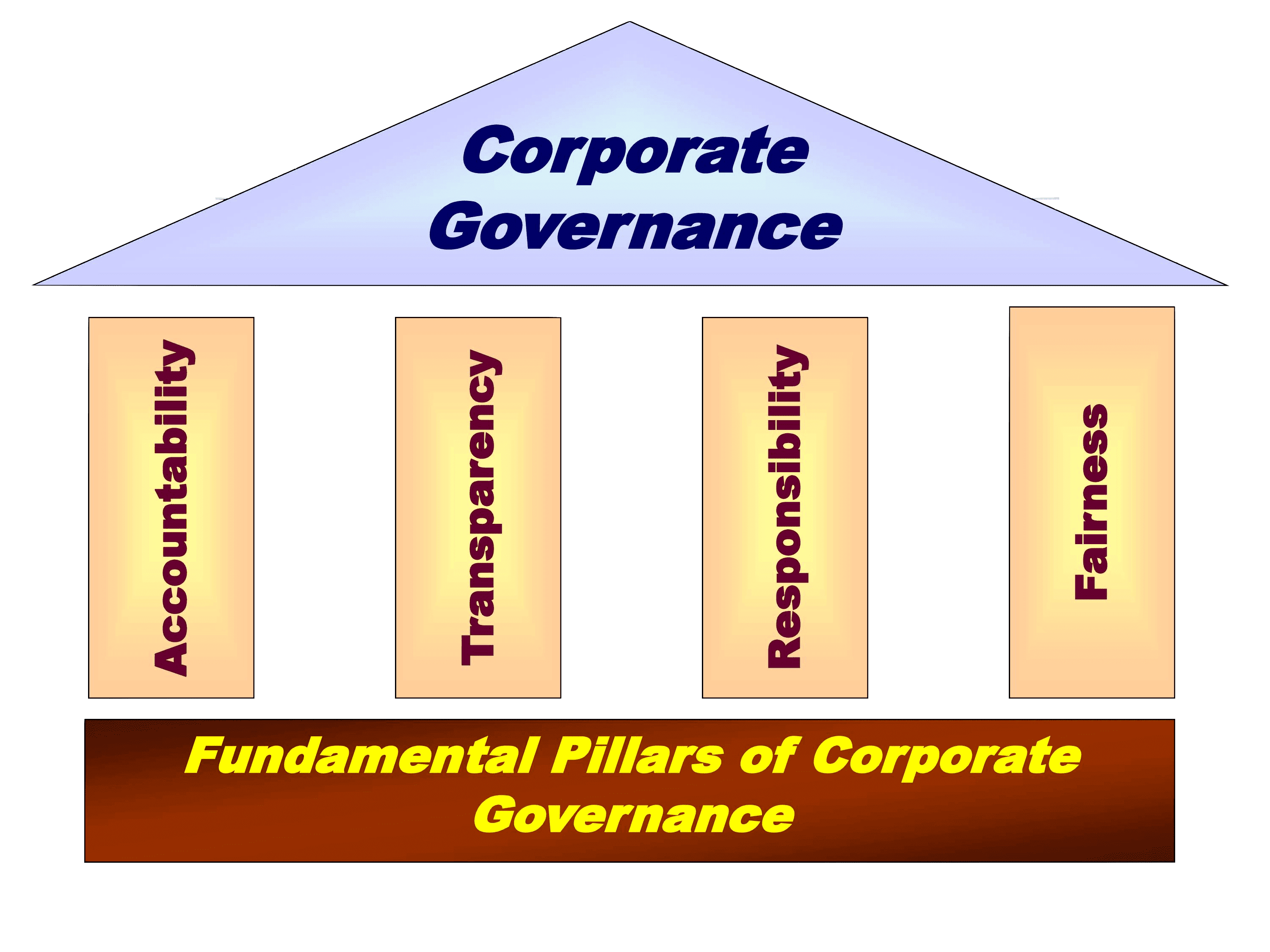

Landmark Shareholder Derivative Suits: Transforming Corporate Governance

The Effects of Landmark Shareholder Derivative Suits

Shareholder derivative suits can have a significant impact on corporate governance. They can force companies to change their policies and procedures, and they can also lead to the removal of directors and officers who have engaged in misconduct.

Thomas A. Beck – Richards, Layton & Finger – Source www.rlf.com

Landmark Shareholder Derivative Suits: Protecting Shareholder Rights

The Benefits of Landmark Shareholder Derivative Suits

Shareholder derivative suits can provide a number of benefits to shareholders. They can help to protect shareholder rights, and they can also help to ensure that companies are held accountable for their actions.

Gap Diversity Lawsuit Could Could Stifle Shareholder Derivative Suits – Source www.bloomberg.com

Landmark Shareholder Derivative Suits: A Personal Story

In 2010, I was a shareholder in a company that was sued by a group of shareholders. The shareholders alleged that the company’s management team had engaged in insider trading. I was initially hesitant to support the lawsuit, but I eventually decided to join the plaintiffs.

The lawsuit was successful, and the company was forced to pay a large settlement to the shareholders. I was glad that I had been able to play a role in holding the company accountable for its actions.

Company law – A derivative suit is a lawsuitbrought by a shareholder on – Source www.studocu.com

Landmark Shareholder Derivative Suits: A Deeper Dive

Shareholder derivative suits are a complex legal matter. However, there are a few key things that you should know about them.

First, shareholder derivative suits are only available to shareholders who have been harmed by the company’s actions. Second, shareholder derivative suits must be filed on behalf of the company, not the individual shareholder.

Finally, shareholder derivative suits can be a long and expensive process. However, they can also be a powerful tool for holding companies accountable for their actions.

Catalent, Inc. – Robbins LLP – Source robbinsllp.com

Landmark Shareholder Derivative Suits: A Rich History

The history of shareholder derivative suits is a long and distinguished one. The first shareholder derivative suit was filed in the United States in 1872. Since then, shareholder derivative suits have been used to hold companies accountable for a wide range of misconduct, including fraud, insider trading, and environmental damage.

Shareholder derivative suits have played a major role in shaping corporate governance in the United States. They have helped to protect shareholder rights and to ensure that companies are held accountable for their actions.

Evolution Of Corporate Governance | PPT – Source www.slideshare.net

Landmark Shareholder Derivative Suits: Uncovering Hidden Secrets

Shareholder derivative suits can be a powerful tool for uncovering hidden secrets. In recent years, shareholder derivative suits have been used to expose a wide range of corporate misconduct, including accounting fraud, environmental violations, and sexual harassment.

Shareholder derivative suits can be a valuable tool for shareholders who are concerned about the way their company is being run. They can help to ensure that companies are held accountable for their actions and that shareholder rights are protected.

What is a Shareholder Derivative Action? – California Business Lawyer – Source california-business-lawyer-corporate-lawyer.com

Landmark Shareholder Derivative Suits: Recommendations

If you are a shareholder who is concerned about the way your company is being run, you may want to consider filing a shareholder derivative suit. Here are a few things to keep in mind:

- Make sure you have a valid claim. You must be able to show that the company’s management team has engaged in misconduct that has harmed the company.

- Get legal advice. Shareholder derivative suits are complex legal matters. It is important to speak with an attorney to discuss your options before filing a lawsuit.

- Be prepared for a long and expensive process. Shareholder derivative suits can take years to resolve and can be very expensive.

What is Corporate Governance? Principles, Examples & More (2023) – Source sailsojourn.com

Landmark Shareholder Derivative Suits: A More Detailed Explanation

Shareholder derivative suits are a powerful tool for shareholders to hold companies accountable for their actions. They can be used to recover damages for the company, and they can also lead to changes in corporate governance.

Shareholder derivative suits are typically brought by a shareholder on behalf of the company. This is because the company itself may be unable or unwilling to bring a lawsuit against its own management team.

To be successful, a shareholder derivative suit must show that the company’s management team has breached its fiduciary duty to the shareholders. This can be done by showing that the management team has engaged in misconduct, such as fraud, self-dealing, or waste of corporate assets.

Landmark Shareholder Derivative Suits: Tips for Success

If you are considering filing a shareholder derivative suit, here are a few tips:

- Make sure you have a valid claim. You must be able to show that the company’s management team has engaged in misconduct that has harmed the company.

- Get legal advice. Shareholder derivative suits are complex legal matters. It is important to speak with an attorney to discuss your options before filing a lawsuit.

- Be prepared for a long and expensive process. Shareholder derivative suits can take years to resolve and can be very expensive.

Landmark Shareholder Derivative Suits: A More Nuanced Approach

Shareholder derivative suits can be a powerful tool for shareholders, but they are not without their limitations. For example, shareholder derivative suits can be expensive and time-consuming, and they can be difficult to win.

In addition, shareholder derivative suits can sometimes be used to harass companies or to extract settlements from them. As a result, it is important to carefully consider the pros and cons of filing a shareholder derivative suit before proceeding.

Landmark Shareholder Derivative Suits: Fun Facts

Here are a few fun facts about shareholder derivative suits:

- The first shareholder derivative suit was filed in the United States in 1872.

- Shareholder derivative suits have been used to recover billions of dollars for shareholders.

- Shareholder derivative suits have been used to hold companies accountable for a wide range of misconduct, including fraud, insider trading, and environmental damage.

Landmark Shareholder Derivative Suits: How to Get Started

If you are interested in filing a shareholder derivative suit, the first step is to speak with an attorney. An attorney can help you assess your case and determine whether you have a valid claim.

If you do have a valid claim, your attorney can help you file a lawsuit and represent you in court. Shareholder derivative suits can be complex and time-consuming, so it is important to have an experienced attorney on your side.

Landmark Shareholder Derivative Suits: What If I Don’t File a Suit?

If you are a shareholder who is concerned about the way your company is being run, but you do not want to file a shareholder derivative suit, there are other options available to you.

You can contact the company’s board of directors and express your concerns. You can also attend shareholder meetings and vote on resolutions. If you are dissatisfied with the company’s management, you can sell your shares.

Landmark Shareholder Derivative Suits: A List of Do’s and Don’ts

Here is a list of do’s and don’ts for filing a shareholder derivative suit:

- Do your research. Make sure you have a valid claim before filing a lawsuit.

- Get legal advice. An experienced attorney can help you assess your case and represent you in court.

- Be prepared for a long and expensive process. Shareholder derivative suits can take years to resolve and can be very expensive.

- Don’t file a lawsuit if you are not prepared to see it through to the end.

- Don’t use a shareholder derivative suit to harass a company or to extract