Buying or selling a property is a complex and often stressful process. One of the most important things to understand is how to use a letter of credit for real estate transactions. A letter of credit is a financial instrument that provides a guarantee that the buyer will be able to pay for the property. This can be especially important in cases where the buyer is not able to provide a traditional mortgage.

Fraud Transaction Complaint Letter to Bank | Forms – Docs – 2023 – Source blanker.org

Why Use a Letter of Credit for Real Estate Transactions?

There are a number of reasons why you might want to use a letter of credit for a real estate transaction. First, it can help you to secure financing for the property. If you are not able to qualify for a traditional mortgage, a letter of credit can provide you with the necessary financing to purchase the property. Second, a letter of credit can protect you from financial loss in the event that the seller is unable to complete the sale. If the seller defaults on the contract, the letter of credit can be used to cover your losses.

Transaction Coordinator Check List Real Estate Check List | Etsy – Source www.pinterest.com

Letter of Credit Helps to Secure Real Estate Transactions

A letter of credit is a financial instrument that guarantees that the buyer of a property will be able to pay for the purchase price. This is especially important for international real estate transactions, where the buyer and seller may not be familiar with each other’s financial situation. A letter of credit provides the seller with assurance that they will be paid, even if the buyer is unable to secure financing.

Real Estate Transaction Coordinator Cover Letter | Velvet Jobs – Source www.velvetjobs.com

Understanding Letter of Credit for Real Estate Transactions

A letter of credit is a financial instrument issued by a bank that guarantees payment to a seller for the sale of goods or services. In the context of real estate transactions, a letter of credit is typically used to secure the purchase price of the property. The letter of credit is issued by the buyer’s bank and is payable to the seller upon the satisfaction of certain conditions, such as the delivery of the deed to the property.

Real Estate Transaction Checklist Templates – Source cashier.mijndomein.nl

History and Myth of Letter of Credit for Real Estate Transactions

Letters of credit have been used for centuries to facilitate trade and commerce. The first known letter of credit was issued in the 12th century by a group of Italian merchants. Over time, letters of credit became increasingly common, and they are now used in a wide variety of international transactions. In the context of real estate transactions, letters of credit are often used to secure the purchase price of the property. The letter of credit is issued by the buyer’s bank and is payable to the seller upon the satisfaction of certain conditions, such as the delivery of the deed to the property.

Real Estate Lawyer Halifax | Real Estate Law Firm – Source www.brookshirelawoffice.com

Letter of Credit for Real Estate Transaction: Hidden Secrets

Letters of credit are a powerful tool that can be used to facilitate real estate transactions. However, there are some hidden secrets that you should be aware of before using a letter of credit. First, letters of credit are not a substitute for due diligence. You should always conduct your own due diligence before entering into a real estate transaction. Second, letters of credit can be expensive. The cost of a letter of credit will vary depending on the amount of the credit and the terms of the letter of credit. Third, letters of credit can be complex. It is important to understand the terms of the letter of credit before you sign it.

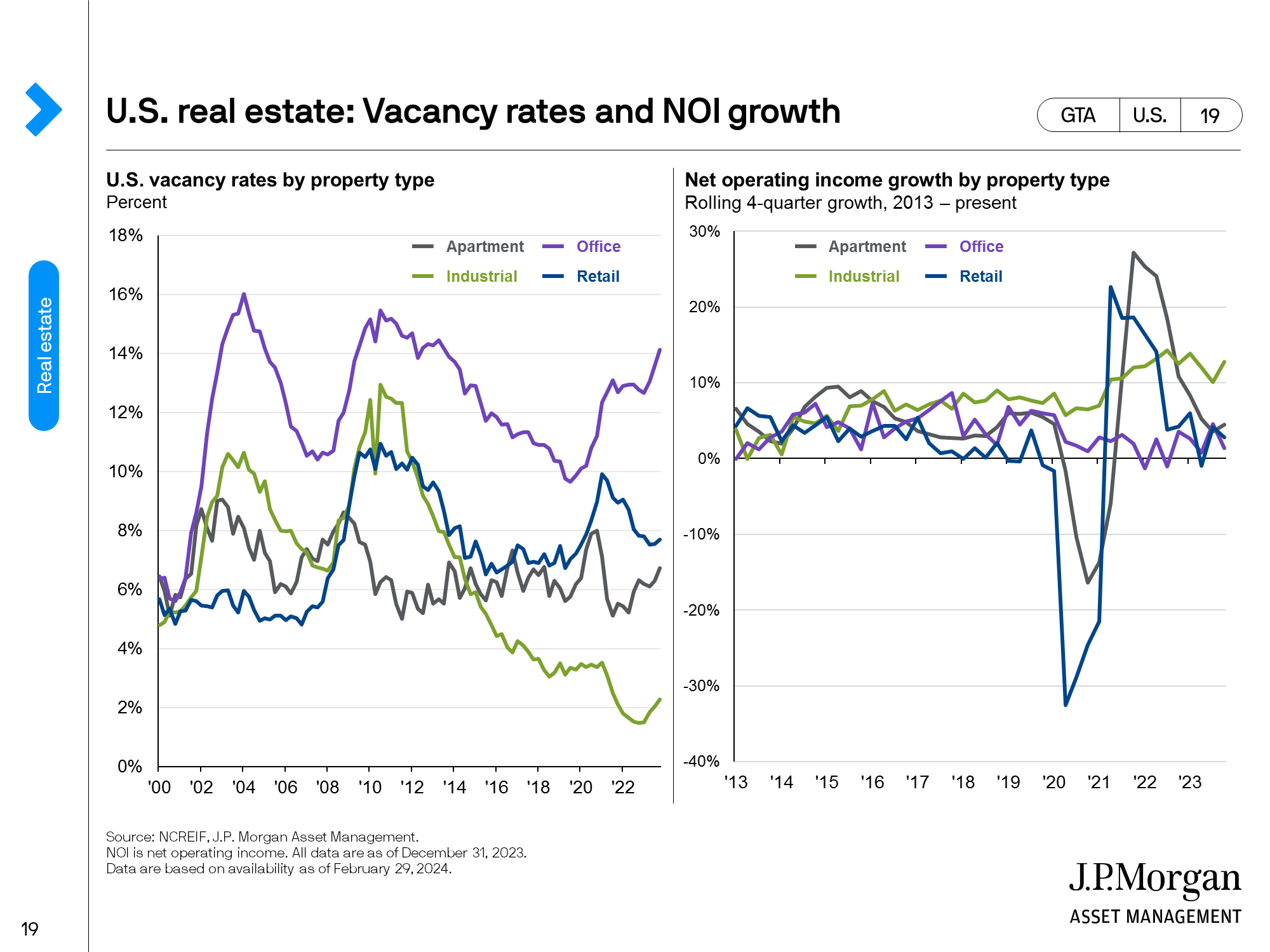

Europe real estate: Transaction volumes – Source am.jpmorgan.com

Recommendation of Letter of Credit for Real Estate Transactions

If you are considering using a letter of credit for a real estate transaction, there are a few things you should keep in mind. First, you should make sure that you understand the terms of the letter of credit. Second, you should obtain a commitment from your bank that they will issue the letter of credit. Third, you should factor the cost of the letter of credit into your budget. Fourth, you should make sure that you have a contingency plan in place in the event that the seller defaults on the contract.

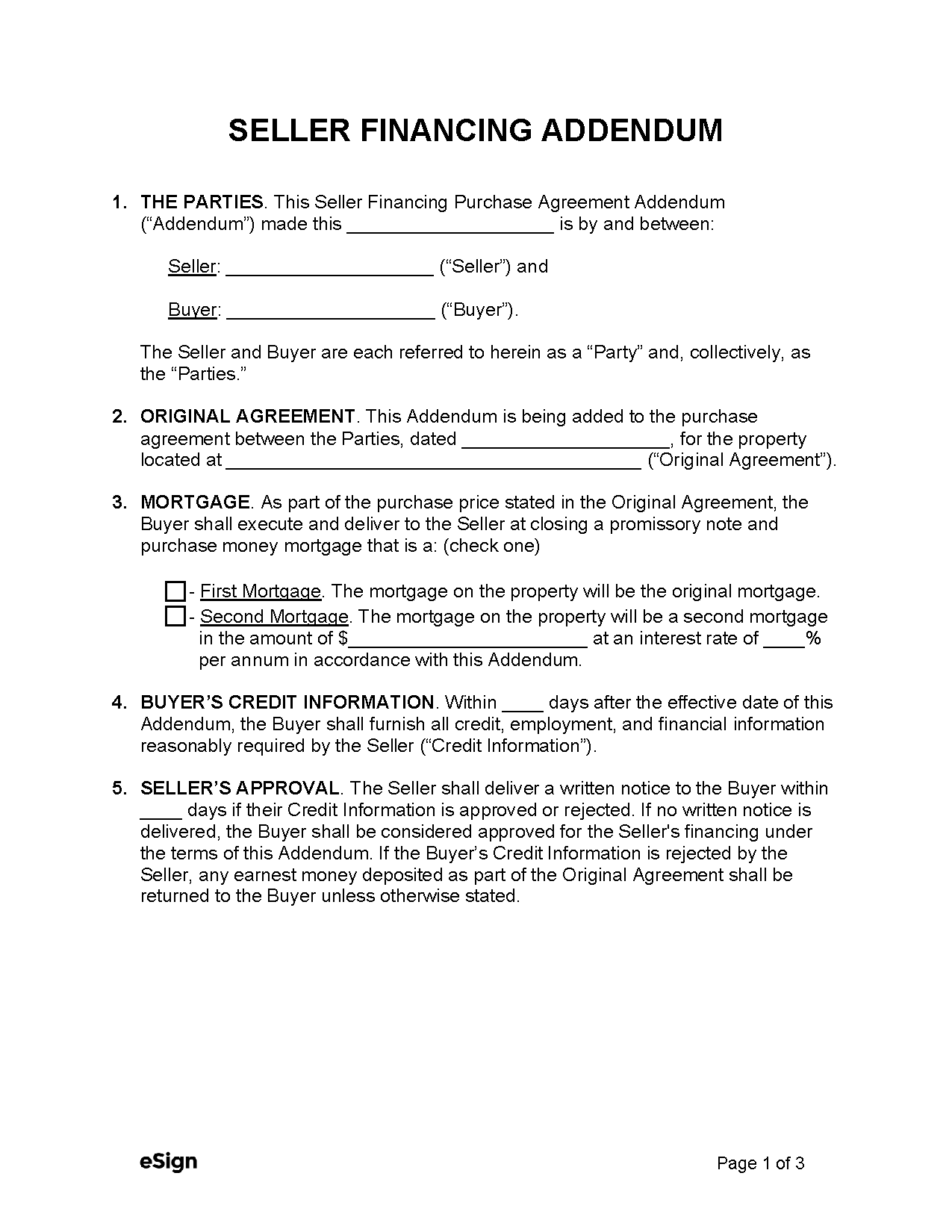

Free Seller Financing Addendum | PDF | Word – Source esign.com

Letter of Credit Helps to Secure Real Estate Transactions

One of the most important things to understand about letters of credit is that they are a secured form of payment. This means that the bank has pledged its own assets to guarantee payment to the seller. As a result, letters of credit are very reliable and are often used in high-value transactions.

Real Estate Transaction Timeline and Closed Sales Tracking – Etsy – Source www.pinterest.com

Tips for Using a Letter of Credit for Real Estate Transactions

There are a few things you can do to make sure that your letter of credit is processed smoothly. First, make sure that you have all of the necessary documentation. This includes the purchase agreement, the closing statement, and the letter of credit. Second, make sure that you follow the instructions on the letter of credit carefully. Third, be prepared to provide additional documentation if requested by the bank.

the real estate transaction coordinater checklist is shown in black and – Source www.pinterest.com

Letter of Credit for Real Estate Transactions Explained

A letter of credit is a financial instrument that guarantees payment to a seller for the sale of goods or services. In the context of real estate transactions, a letter of credit is typically used to secure the purchase price of the property. The letter of credit is issued by the buyer’s bank and is payable to the seller upon the satisfaction of certain conditions, such as the delivery of the deed to the property.

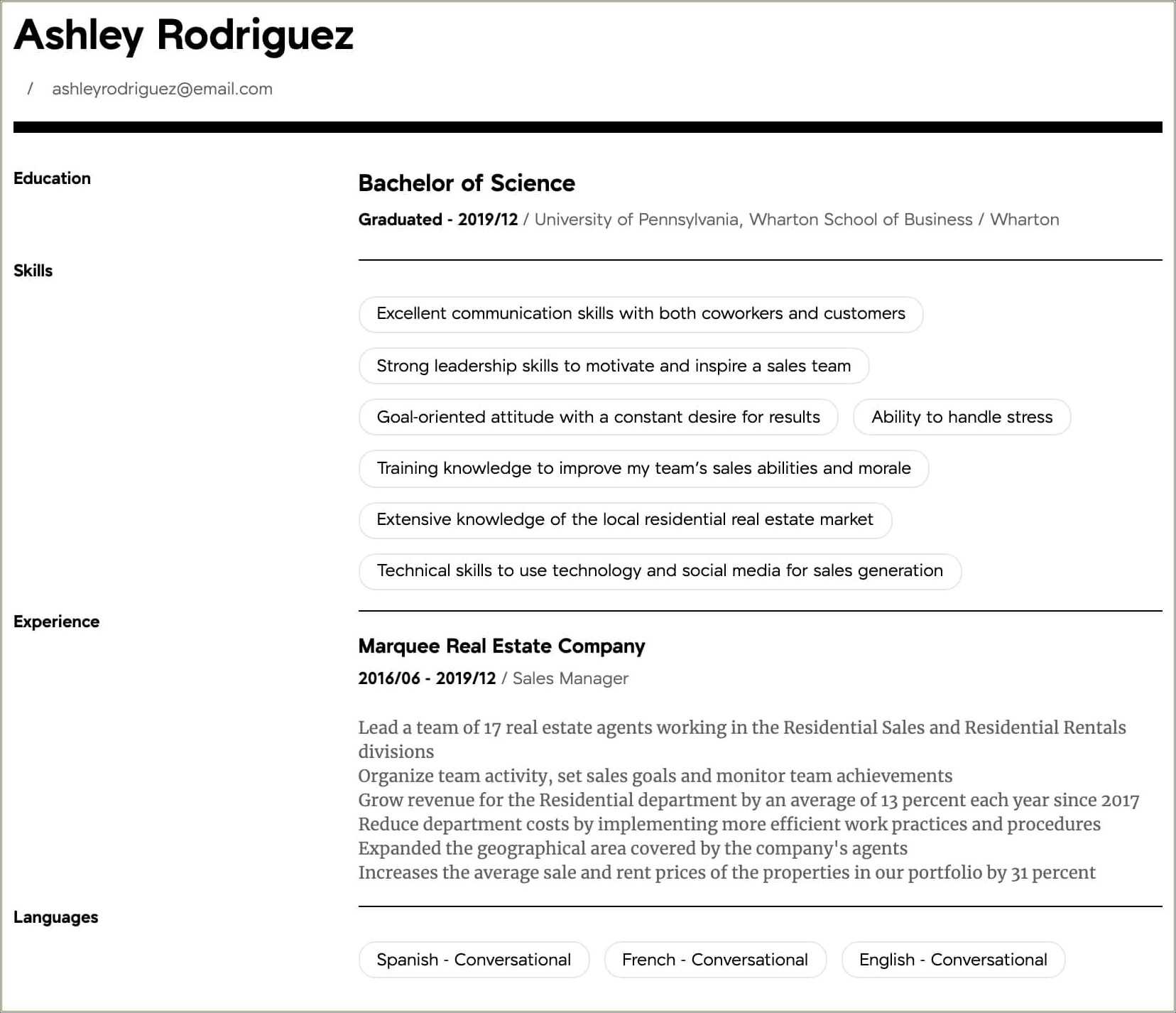

Real Estate Sales Manager Resume – Resume Example Gallery – Source www.davidkowalski.nl

Fun Facts of Letter Of Credit For Real Estate Transaction

Letters of credit are a very common way to secure real estate transactions. In fact, they are often required by lenders when the buyer is not able to provide a traditional mortgage. Letters of credit can also be used to finance the purchase of land, construction costs, and other expenses associated with real estate transactions.

How to Use a Letter of Credit for Real Estate Transactions

Using a letter of credit for a real estate transaction is a relatively simple process. First, you will need to contact your bank and request a letter of credit. The bank will then review your financial situation and determine if you are eligible for a letter of credit. If you are approved, the bank will issue a letter of credit to the seller. The letter of credit will specify the amount of the purchase price that is guaranteed by the bank.

What if Letter of Credit for Real Estate Transactions Fail?

In the event that the seller defaults on the contract, the buyer can file a claim with the bank that issued the letter of credit. The bank will then investigate the claim and determine if the seller is liable for payment. If the seller is found to be liable, the bank will pay the buyer the amount of the purchase price that is guaranteed by the letter of credit.

Listicle of Letter of Credit for Real Estate Transactions

- Letters of credit are a secure form of payment.

- Letters of credit are often required by lenders when the buyer is not able to provide a traditional mortgage.

- Letters of credit can be used to finance the purchase of land, construction costs, and other expenses associated with real estate transactions.

Questions and Answers about Letter of Credit for Real Estate Transactions

- What is a letter of credit?

A letter of credit is a financial instrument that guarantees payment to a seller for the sale of goods or services. - How can I use a letter of credit for a real estate transaction?

You can use a letter of credit to secure the purchase price of a property, finance the purchase of land, or pay for construction costs. - What are the benefits of using a letter of credit?

Letters of credit are a secure form of payment and can be used to obtain financing even if you do not have a traditional mortgage. - What are the risks of using a letter of credit?

The main risk of using a letter of credit is that you may be liable for payment even if the seller defaults on the contract.

Conclusion of Letter Of Credit For Real Estate Transaction

Letters of credit are a powerful tool that can be used to facilitate real estate transactions. However, it is important to understand the terms of the letter of credit before you sign it. You should also make sure that you have a contingency plan in place in the event that the seller defaults on the contract.