Corporate Transparency And Beneficial Ownership Disclosure In Real Estate Transactions: What You Need To Know

When it comes to real estate transactions, transparency is key. Buyers and sellers need to know who they are dealing with in order to make informed decisions. However, in the past, it has been difficult to track the beneficial owners of real estate, making it easy for criminals to launder money and hide their assets.

Corporate Transparency And Beneficial Ownership Disclosure In Real Estate Transactions

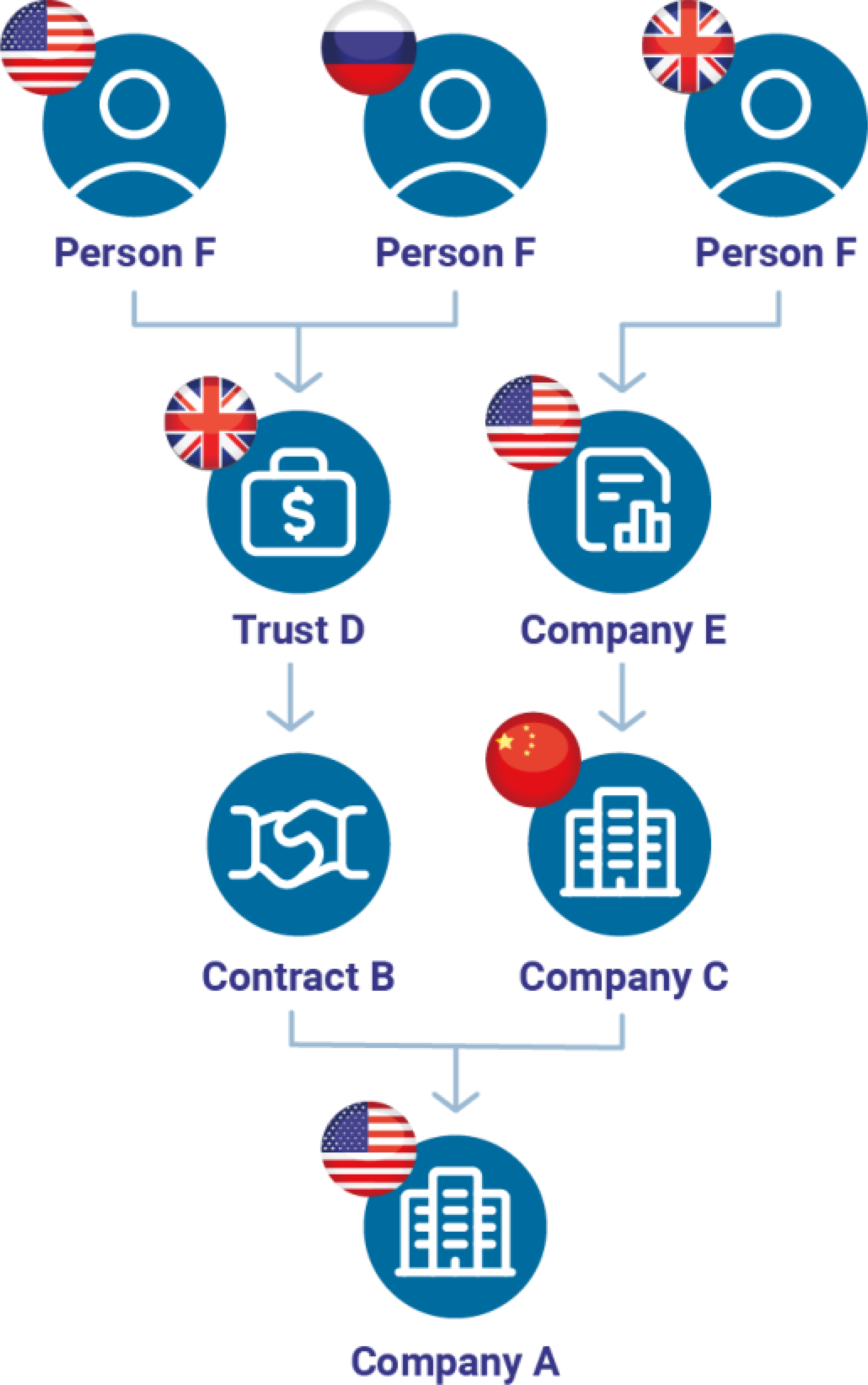

The Corporate Transparency and Beneficial Ownership Act of 2020 (CTBOA) aims to address this problem by requiring certain companies to disclose their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This information will be available to law enforcement and other government agencies, helping them to track down criminals and prevent financial crimes.

The CTBOA defines a beneficial owner as any individual who, directly or indirectly, exercises substantial control over a company. This can include people who own more than 25% of a company’s shares or have the right to vote more than 25% of a company’s shares.

2. Key concepts | openownership.org – Source www.openownership.org

Who Does The CTBOA Apply To?

The CTBOA applies to all corporations, limited liability companies (LLCs), and other similar entities that are created or registered in the United States. It also applies to foreign companies that have a physical presence in the United States.

There are some exceptions to the CTBOA, including companies that are publicly traded on a stock exchange and companies that are owned by a government entity.

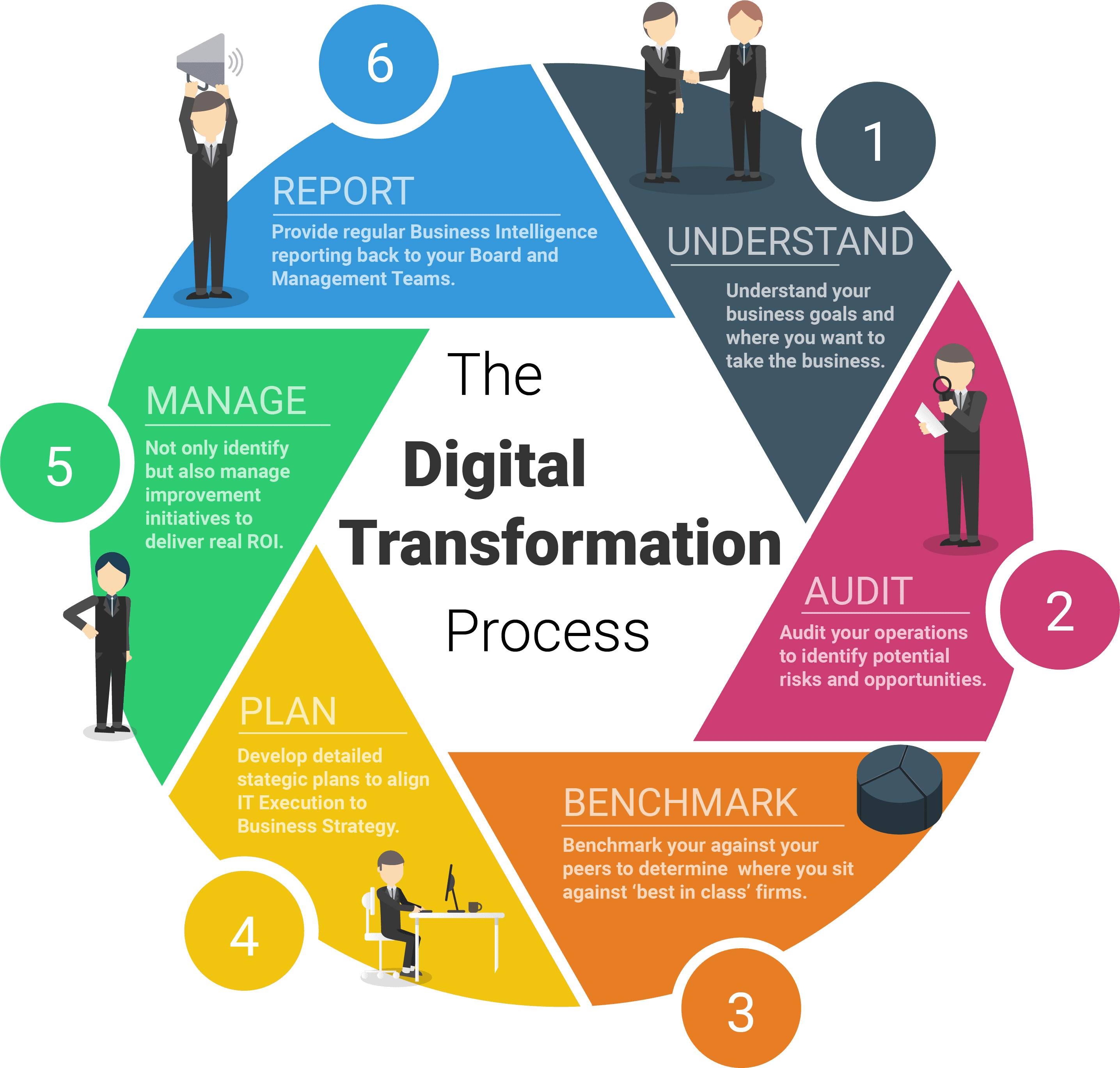

The Corporate Transparency Act: Beneficial Ownership Reporting and the – Source graydon.law

What Information Do I Need To Disclose?

If you are a beneficial owner of a company that is subject to the CTBOA, you must disclose the following information to FinCEN:

- Your name

- Your date of birth

- Your address

- Your Social Security number or passport number

- Your ownership interest in the company

You must also provide FinCEN with a copy of your passport or other government-issued identification.

The Corporate Transparency Act: New Requirements for Business Owners – Source info.gutweinlaw.com

When Do I Need To Disclose This Information?

You must disclose this information to FinCEN within 30 days of becoming a beneficial owner of a company. You must also update this information within 30 days of any changes to your ownership interest or other information that you have provided to FinCEN.

Failure to disclose this information can result in civil penalties of up to $50,000 per violation.

Corporate Transparency Act Beneficial Ownership Information (BOI – Source www.gulfcoastbusinesslawblog.com

Conclusion of Corporate Transparency And Beneficial Ownership Disclosure In Real Estate Transactions

The CTBOA is an important step towards increasing transparency in the real estate market. By requiring companies to disclose their beneficial owners, the CTBOA will make it more difficult for criminals to launder money and hide their assets. This will help to protect the integrity of the real estate market and make it a safer place for everyone.